Part 52 - Solicitation Provisions and Contract Clauses

Subpart 52.1 - Instructions for Using Provisions and Clauses

52.102 Incorporating provisions and clauses.

52.103 Identification of provisions and clauses.

52.104 Procedures for modifying and completing provisions and clauses.

52.105 Procedures for using alternates.

52.107 Provisions and clauses prescribed in subpart 52.1.

Subpart 52.2 - Text of Provisions and Clauses

52.201-1 Acquisition 360: Voluntary Survey.

52.203-2 Certificate of Independent Price Determination.

52.203-5 Covenant Against Contingent Fees.

52.203-6 Restrictions on Subcontractor Sales to the Government.

52.203-7 Anti-Kickback Procedures.

52.203-8 Cancellation, Rescission, and Recovery of Funds for Illegal or Improper Activity.

52.203-10 Price or Fee Adjustment for Illegal or Improper Activity.

52.203-11 Certification and Disclosure Regarding Payments to Influence Certain Federal Transactions.

52.203-12 Limitation on Payments to Influence Certain Federal Transactions.

52.203-13 Contractor Code of Business Ethics and Conduct.

52.203-14 Display of Hotline Poster(s).

52.203-15 Whistleblower Protections Under the American Recovery and Reinvestment Act of 2009.

52.203-16 Preventing Personal Conflicts of Interest.

52.203-17 Contractor Employee Whistleblower Rights.

52.203-19 Prohibition on Requiring Certain Internal Confidentiality Agreements or Statements.

52.204-1 Approval of Contract.

52.204-2 Security Requirements.

52.204-3 Taxpayer Identification.

52.204-5 Women-Owned Business (Other Than Small Business).

52.204-6 Unique Entity Identifier.

52.204-7 System for Award Management.

52.204-8 Annual Representations and Certifications.

52.204-9 Personal Identity Verification of Contractor Personnel.

52.204-10 Reporting Executive Compensation and First-Tier Subcontract Awards.

52.204-12 Unique Entity Identifier Maintenance.

52.204-13 System for Award Management Maintenance.

52.204-14 Service Contract Reporting Requirements.

52.204-15 Service Contract Reporting Requirements for Indefinite-Delivery Contracts.

52.204-16 Commercial and Government Entity Code Reporting.

52.204-17 Ownership or Control of Offeror.

52.204-18 Commercial and Government Entity Code Maintenance.

52.204-19 Incorporation by Reference of Representations and Certifications.

52.204-20 Predecessor of Offeror.

52.204-21 Basic Safeguarding of Covered Contractor Information Systems.

52.204-22 Alternative Line Item Proposal.

52.204-26 Covered Telecommunications Equipment or Services-Representation.

52.204-27 Prohibition on a ByteDance Covered Application.

52.204-29 Federal Acquisition Supply Chain Security Act Orders—Representation and Disclosures.

52.204-30 Federal Acquisition Supply Chain Security Act Orders—Prohibition.

52.207-1 Notice of Standard Competition.

52.207-2 Notice of Streamlined Competition.

52.207-3 Right of First Refusal of Employment.

52.207-4 Economic Purchase Quantity-Supplies.

52.207-5 Option to Purchase Equipment.

52.208-4 Vehicle Lease Payments.

52.208-5 Condition of Leased Vehicles.

52.208-6 Marking of Leased Vehicles.

52.208-7 Tagging of Leased Vehicles.

52.208-9 Contractor Use of Mandatory Sources of Supply or Services.

52.209-1 Qualification Requirements.

52.209-2 Prohibition on Contracting with Inverted Domestic Corporations-Representation.

52.209-3 First Article Approval-Contractor Testing.

52.209-4 First Article Approval-Government Testing.

52.209-5 Certification Regarding Responsibility Matters.

52.209-7 Information Regarding Responsibility Matters.

52.209-9 Updates of Publicly Available Information Regarding Responsibility Matters.

52.209-10 Prohibition on Contracting with Inverted Domestic Corporations.

52.209-12 Certification Regarding Tax Matters.

52.209-13 Violation of Arms Control Treaties or Agreements-Certification.

52.209-14 Reserve Officer Training Corps and Military Recruiting on Campus.

52.211-5 Material Requirements.

52.211-7 Alternatives to Government-Unique Standards.

52.211-9 Desired and Required Time of Delivery.

52.211-10 Commencement, Prosecution, and Completion of Work.

52.211-11 Liquidated Damages-Supplies, Services, or Research and Development.

52.211-12 Liquidated Damages-Construction.

52.211-15 Defense Priority and Allocation Requirements.

52.211-16 Variation in Quantity.

52.211-17 Delivery of Excess Quantities.

52.211-18 Variation in Estimated Quantity.

52.212-1 Instructions to Offerors—Commercial Products and Commercial Services.

52.212-2 Evaluation—Commercial Products and Commercial Services.

52.212-3 Offeror Representations and Certifications—Commercial Products and Commercial Services.

52.212-4 Contract Terms and Conditions—Commercial Products and Commercial Services.

52.213-1 Fast Payment Procedure.

52.214-3 Amendments to Invitations for Bids.

52.214-4 False Statements in Bids.

52.214-6 Explanation to Prospective Bidders.

52.214-7 Late Submissions, Modifications, and Withdrawals of Bids.

52.214-10 Contract Award-Sealed Bidding.

52.214-12 Preparation of Bids.

52.214-14 Place of Performance-Sealed Bidding.

52.214-15 Period for Acceptance of Bids.

52.214-16 Minimum Bid Acceptance Period.

52.214-18 Preparation of Bids-Construction.

52.214-19 Contract Award-Sealed Bidding-Construction.

52.214-21 Descriptive Literature.

52.214-22 Evaluation of Bids for Multiple Awards.

52.214-24 Multiple Technical Proposals.

52.214-25 Step Two of Two-Step Sealed Bidding.

52.214-26 Audit and Records-Sealed Bidding.

52.214-27 Price Reduction for Defective Certified Cost or Pricing Data-Modifications-Sealed Bidding.

52.214-28 Subcontractor Certified Cost or Pricing Data-Modifications-Sealed Bidding.

52.214-29 Order of Precedence-Sealed Bidding.

52.214-34 Submission of Offers in the English Language.

52.214-35 Submission of Offers in U.S. Currency.

52.215-1 Instructions to Offerors-Competitive Acquisition.

52.215-2 Audit and Records-Negotiation.

52.215-3 Request for Information or Solicitation for Planning Purposes.

52.215-6 Place of Performance.

52.215-8 Order of Precedence-Uniform Contract Format.

52.215-9 Changes or Additions to Make-or-Buy Program.

52.215-10 Price Reduction for Defective Certified Cost or Pricing Data.

52.215-11 Price Reduction for Defective Certified Cost or Pricing Data-Modifications.

52.215-12 Subcontractor Certified Cost or Pricing Data.

52.215-13 Subcontractor Certified Cost or Pricing Data-Modifications.

52.215-14 Integrity of Unit Prices.

52.215-15 Pension Adjustments and Asset Reversions.

52.215-16 Facilities Capital Cost of Money.

52.215-17 Waiver of Facilities Capital Cost of Money.

52.215-18 Reversion or Adjustment of Plans for Postretirement Benefits (PRB) Other Than Pensions.

52.215-19 Notification of Ownership Changes.

52.215-22 Limitations on Pass-Through Charges-Identification of Subcontract Effort.

52.215-23 Limitations on Pass-Through Charges.

52.216-2 Economic Price Adjustment-Standard Supplies.

52.216-3 Economic Price Adjustment-Semistandard Supplies.

52.216-4 Economic Price Adjustment-Labor and Material.

52.216-5 Price Redetermination-Prospective.

52.216-6 Price Redetermination-Retroactive.

52.216-7 Allowable Cost and Payment.

52.216-9 Fixed Fee-Construction.

52.216-11 Cost Contract-No Fee.

52.216-12 Cost-Sharing Contract-No Fee.

52.216-15 Predetermined Indirect Cost Rates.

52.216-16 Incentive Price Revision-Firm Target.

52.216-17 Incentive Price Revision-Successive Targets.

52.216-22 Indefinite Quantity.

52.216-23 Execution and Commencement of Work.

52.216-24 Limitation of Government Liability.

52.216-25 Contract Definitization.

52.216-26 Payments of Allowable Costs Before Definitization.

52.216-27 Single or Multiple Awards.

52.216-28 Multiple Awards for Advisory and Assistance Services.

52.216-31 Time-and-Materials/Labor-Hour Proposal Requirements—Commercial Acquisition.

52.216-32 Task-Order and Delivery-Order Ombudsman.

52.217-2 Cancellation Under Multi-year Contracts.

52.217-3 Evaluation Exclusive of Options.

52.217-4 Evaluation of Options Exercised at Time of Contract Award.

52.217-5 Evaluation of Options.

52.217-6 Option for Increased Quantity.

52.217-7 Option for Increased Quantity-Separately Priced Line Item.

52.217-8 Option to Extend Services.

52.217-9 Option to Extend the Term of the Contract.

52.217-11 Reverse Auction—Orders.

52.217-12 Reverse Auction Services.

52.219-1 Small Business Program Representations.

52.219-3 Notice of HUBZone Set-Aside or Sole-Source Award.

52.219-4 Notice of Price Evaluation Preference for HUBZone Small Business Concerns.

52.219-6 Notice of Total Small Business Set-Aside.

52.219-7 Notice of Partial Small Business Set-Aside.

52.219-8 Utilization of Small Business Concerns.

52.219-9 Small Business Subcontracting Plan.

52.219-10 Incentive Subcontracting Program.

52.219-11 Special 8(a) Contract Conditions.

52.219-12 Special 8(a) Subcontract Conditions.

52.219-13 Notice of Set-Aside of Orders.

52.219-14 Limitations on Subcontracting.

52.219-16 Liquidated Damages-Subcontracting Plan.

52.219-18 Notification of Competition Limited to Eligible 8(a) Participants.

52.219-28 Postaward Small Business Program Rerepresentation.

52.219-31 Notice of Small Business Reserve.

52.219-32 Orders Issued Directly Under Small Business Reserves

52.219-33 Nonmanufacturer Rule.

52.222-1 Notice to the Government of Labor Disputes.

52.222-2 Payment for Overtime Premiums.

52.222-4 Contract Work Hours and Safety Standards -Overtime Compensation.

52.222-5 Construction Wage Rate Requirements-Secondary Site of the Work.

52.222-6 Construction Wage Rate Requirements.

52.222-7 Withholding of Funds.

52.222-8 Payrolls and Basic Records.

52.222-9 Apprentices and Trainees.

52.222-10 Compliance with Copeland Act Requirements.

52.222-11 Subcontracts (Labor Standards).

52.222-12 Contract Termination-Debarment.

52.222-13 Compliance with Construction Wage Rate Requirements and Related Regulations.

52.222-14 Disputes Concerning Labor Standards.

52.222-15 Certification of Eligibility.

52.222-16 Approval of Wage Rates.

52.222-18 Certification Regarding Knowledge of Child Labor for Listed End Products.

52.222-19 Child Labor-Cooperation with Authorities and Remedies.

52.222-20 Contracts for Materials, Supplies, Articles, and Equipment.

52.222-21 Prohibition of Segregated Facilities.

52.222-22 Previous Contracts and Compliance Reports.

52.222-24 Preaward On-Site Equal Opportunity Compliance Evaluation.

52.222-25 Affirmative Action Compliance.

52.222-27 Affirmative Action Compliance Requirements for Construction.

52.222-29 Notification of Visa Denial.

52.222-31 Construction Wage Rate Requirements-Price Adjustment (Percentage Method).

52.222-32 Construction Wage Rate Requirements-Price Adjustment (Actual Method).

52.222-33 Notice of Requirement for Project Labor Agreement.

52.222-34 Project Labor Agreement.

52.222-35 Equal Opportunity for Veterans.

52.222-36 Equal Opportunity for Workers with Disabilities.

52.222-37 Employment Reports on Veterans.

52.222-38 Compliance with Veterans’ Employment Reporting Requirements.

52.222-40 Notification of Employee Rights Under the National Labor Relations Act.

52.222-41 Service Contract Labor Standards.

52.222-42 Statement of Equivalent Rates for Federal Hires.

52.222-44 Fair Labor Standards Act and Service Contract Labor Standards-Price Adjustment.

52.222-46 Evaluation of Compensation for Professional Employees.

52.222-49 Service Contract Labor Standards-Place of Performance Unknown.

52.222-50 Combating Trafficking in Persons.

52.222-54 Employment Eligibility Verification.

52.222-55 Minimum Wages for Contractor Workers Under Executive Order 14026.

52.222-56 Certification Regarding Trafficking in Persons Compliance Plan.

52.222-62 Paid Sick Leave Under Executive Order 13706.

52.223-1 Biobased Product Certification.

52.223-2 Reporting of Biobased Products Under Service and Construction Contracts.

52.223-3 Hazardous Material Identification and Material Safety Data.

52.223-4 Recovered Material Certification.

52.223-5 Pollution Prevention and Right-to-Know Information.

52.223-7 Notice of Radioactive Materials.

52.223-9 Estimate of Percentage of Recovered Material Content for EPA-Designated Items.

52.223-10 Waste Reduction Program.

52.223-11 Ozone-Depleting Substances and High Global Warming Potential Hydrofluorocarbons.

52.223-12 Maintenance, Service, Repair, or Disposal of Refrigeration Equipment and Air Conditioners.

52.223-19 Compliance with Environmental Management Systems.

52.223-22 Public Disclosure of Greenhouse Gas Emissions and Reduction Goals-Representation.

52.223-23 Sustainable Products and Services.

52.224-1 Privacy Act Notification.

52.225-1 Buy American-Supplies

52.225-2 Buy American Certificate.

52.225-3 Buy American-Free Trade Agreements-Israeli Trade Act.

52.225-4 Buy American-Free Trade Agreements-Israeli Trade Act Certificate.

52.225-6 Trade Agreements Certificate.

52.225-7 Waiver of Buy American Statute for Civil Aircraft and Related Articles.

52.225-9 Buy American-Construction Materials.

52.225-10 Notice of Buy American Requirement-Construction Materials.

52.225-11 Buy American-Construction Materials under Trade Agreements.

52.225-12 Notice of Buy American Requirement-Construction Materials Under Trade Agreements.

52.225-13 Restrictions on Certain Foreign Purchases.

52.225-14 Inconsistency between English Version and Translation of Contract.

52.225-17 Evaluation of Foreign Currency Offers.

52.225-18 Place of Manufacture.

52.225-20 Prohibition on Conducting Restricted Business Operations in Sudan-Certification.

52.225-26 Contractors Performing Private Security Functions Outside the United States.

52.226-1 Utilization of Indian Organizations and Indian-Owned Economic Enterprises.

52.226-2 Historically Black College or University and Minority Institution Representation.

52.226-3 Disaster or Emergency Area Representation.

52.226-4 Notice of Disaster or Emergency Area Set-Aside.

52.226-5 Restrictions on Subcontracting Outside Disaster or Emergency Area.

52.226-6 Promoting Excess Food Donation to Nonprofit Organizations.

52.226-8 Encouraging Contractor Policies to Ban Text Messaging While Driving.

52.227-1 Authorization and Consent.

52.227-2 Notice and Assistance Regarding Patent and Copyright Infringement.

52.227-4 Patent Indemnity-Construction Contracts.

52.227-7 Patents-Notice of Government Licensee.

52.227-10 Filing of Patent Applications-Classified Subject Matter.

52.227-11 Patent Rights-Ownership by the Contractor.

52.227-13 Patent Rights-Ownership by the Government.

52.227-14 Rights in Data-General.

52.227-15 Representation of Limited Rights Data and Restricted Computer Software.

52.227-16 Additional Data Requirements.

52.227-17 Rights in Data-Special Works.

52.227-18 Rights in Data-Existing Works.

52.227-19 Commercial Computer Software License.

52.227-20 Rights in Data-SBIR Program.

52.227-21 Technical Data Declaration, Revision, and Withholding of Payment-Major Systems.

52.227-22 Major System-Minimum Rights.

52.227-23 Rights to Proposal Data (Technical).

52.228-2 Additional Bond Security.

52.228-3 Workers’ Compensation Insurance (Defense Base Act).

52.228-4 Workers’ Compensation and War-Hazard Insurance Overseas.

52.228-5 Insurance-Work on a Government Installation.

52.228-7 Insurance-Liability to Third Persons.

52.228-8 Liability and Insurance-Leased Motor Vehicles.

52.228-10 Vehicular and General Public Liability Insurance.

52.228-11 Individual Surety—Pledge of Assets.

52.228-12 Prospective Subcontractor Requests for Bonds.

52.228-13 Alternative Payment Protections.

52.228-14 Irrevocable Letter of Credit.

52.228-15 Performance and Payment Bonds-Construction.

52.228-16 Performance and Payment Bonds-Other Than Construction.

52.228-17 Individual Surety—Pledge of Assets (Bid Guarantee).

52.229-1 State and Local Taxes.

52.229-2 North Carolina State and Local Sales and Use Tax.

52.229-3 Federal, State, and Local Taxes.

52.229-4 Federal, State, and Local Taxes (State and Local Adjustments).

52.229-6 Taxes-Foreign Fixed-Price Contracts.

52.229-7 Taxes-Fixed-Price Contracts with Foreign Governments.

52.229-8 Taxes-Foreign Cost-Reimbursement Contracts.

52.229-9 Taxes-Cost-Reimbursement Contracts with Foreign Governments.

52.229-10 State of New Mexico Gross Receipts and Compensating Tax.

52.229-11 Tax on Certain Foreign Procurements—Notice and Representation.

52.229-12 Tax on Certain Foreign Procurements.

52.229-13 Taxes—Foreign Contracts in Afghanistan.

52.230-1 Cost Accounting Standards Notices and Certification.

52.230-2 Cost Accounting Standards.

52.230-3 Disclosure and Consistency of Cost Accounting Practices.

52.230-4 Disclosure and Consistency of Cost Accounting Practices-Foreign Concerns.

52.230-5 Cost Accounting Standards-Educational Institution.

52.230-6 Administration of Cost Accounting Standards.

52.230-7 Proposal Disclosure-Cost Accounting Practice Changes.

52.232-2 Payments under Fixed-Price Research and Development Contracts.

52.232-3 Payments under Personal Services Contracts.

52.232-4 Payments under Transportation Contracts and Transportation-Related Services Contracts.

52.232-5 Payments under Fixed-Price Construction Contracts.

52.232-6 Payment under Communication Service Contracts with Common Carriers.

52.232-7 Payments under Time-and-Materials and Labor-Hour Contracts.

52.232-8 Discounts for Prompt Payment.

52.232-9 Limitation on Withholding of Payments.

52.232-10 Payments under Fixed-Price Architect-Engineer Contracts.

52.232-13 Notice of Progress Payments.

52.232-14 Notice of Availability of Progress Payments Exclusively for Small Business Concerns.

52.232-15 Progress Payments Not Included.

52.232-18 Availability of Funds.

52.232-19 Availability of Funds for the Next Fiscal Year.

52.232-22 Limitation of Funds.

52.232-23 Assignment of Claims.

52.232-24 Prohibition of Assignment of Claims.

52.232-26 Prompt Payment for Fixed-Price Architect-Engineer Contracts.

52.232-27 Prompt Payment for Construction Contracts.

52.232-28 Invitation to Propose Performance-Based Payments.

52.232-29 Terms for Financing of Purchases of Commercial Products and Commercial Services.

52.232-30 Installment Payments for Commercial Products and Commercial Services.

52.232-31 Invitation to Propose Financing Terms.

52.232-32 Performance-Based Payments.

52.232-33 Payment by Electronic Funds Transfer-System for Award Management.

52.232-34 Payment by Electronic Funds Transfer-Other than System for Award Management.

52.232-35 Designation of Office for Government Receipt of Electronic Funds Transfer Information.

52.232-36 Payment by Third Party.

52.232-37 Multiple Payment Arrangements.

52.232-38 Submission of Electronic Funds Transfer Information with Offer.

52.232-39 Unenforceability of Unauthorized Obligations.

52.232-40 Providing Accelerated Payments to Small Business Subcontractors.

52.233-4 Applicable Law for Breach of Contract Claim.

52.234-1 Industrial Resources Developed Under Title III, Defense Production Act.

52.234-2 Notice of Earned Value Management System-Preaward Integrated Baseline Review.

52.234-3 Notice of Earned Value Management System-Post Award Postaward Integrated Baseline Review.

52.234-4 Earned Value Management System.

52.236-1 Performance of Work by the Contractor.

52.236-2 Differing Site Conditions.

52.236-3 Site Investigation and Conditions Affecting the Work.

52.236-5 Material and Workmanship.

52.236-6 Superintendence by the Contractor.

52.236-7 Permits and Responsibilities.

52.236-9 Protection of Existing Vegetation, Structures, Equipment, Utilities, and Improvements.

52.236-10 Operations and Storage Areas.

52.236-11 Use and Possession Prior to Completion.

52.236-13 Accident Prevention.

52.236-14 Availability and Use of Utility Services.

52.236-15 Schedules for Construction Contracts.

52.236-18 Work Oversight in Cost-Reimbursement Construction Contracts.

52.236-19 Organization and Direction of the Work.

52.236-21 Specifications and Drawings for Construction.

52.236-22 Design Within Funding Limitations.

52.236-23 Responsibility of the Architect-Engineer Contractor.

52.236-24 Work Oversight in Architect-Engineer Contracts.

52.236-25 Requirements for Registration of Designers.

52.236-26 Preconstruction Conference.

52.236-27 Site Visit (Construction).

52.236-28 Preparation of Proposals-Construction.

52.237-2 Protection of Government Buildings, Equipment, and Vegetation.

52.237-3 Continuity of Services.

52.237-4 Payment by Government to Contractor.

52.237-5 Payment by Contractor to Government.

52.237-6 Incremental Payment by Contractor to Government.

52.237-7 Indemnification and Medical Liability Insurance.

52.237-8 Restriction on Severance Payments to Foreign Nationals.

52.237-9 Waiver of Limitation on Severance Payments to Foreign Nationals.

52.237-10 Identification of Uncompensated Overtime.

52.239-1 Privacy or Security Safeguards.

52.241-1 Electric Service Territory Compliance Representation.

52.241-2 Order of Precedence-Utilities.

52.241-3 Scope and Duration of Contract.

52.241-4 Change in Class of Service.

52.241-5 Contractor’s Facilities.

52.241-7 Change in Rates or Terms and Conditions of Service for Regulated Services.

52.241-8 Change in Rates or Terms and Conditions of Service for Unregulated Services.

52.241-10 Termination Liability.

52.241-11 Multiple Service Locations.

52.241-12 Nonrefundable, Nonrecurring Service Charge.

52.242-1 Notice of Intent to Disallow Costs.

52.242-2 Production Progress Reports.

52.242-3 Penalties for Unallowable Costs.

52.242-4 Certification of Final Indirect Costs.

52.242-5 Payments to Small Business Subcontractors.

52.242-17 Government Delay of Work.

52.243-2 Changes-Cost-Reimbursement.

52.243-3 Changes-Time-and-Materials or Labor-Hours.

52.243-5 Changes and Changed Conditions.

52.243-6 Change Order Accounting.

52.243-7 Notification of Changes.

52.244-4 Subcontractors and Outside Associates and Consultants (Architect-Engineer Services).

52.244-5 Competition in Subcontracting.

52.244-6 Subcontracts for Commercial Products and Commercial Services.

52.245-2 Government Property Installation Operation Services.

52.246-1 Contractor Inspection Requirements.

52.246-2 Inspection of Supplies-Fixed-Price.

52.246-3 Inspection of Supplies-Cost-Reimbursement.

52.246-4 Inspection of Services-Fixed-Price.

52.246-5 Inspection of Services-Cost-Reimbursement.

52.246-6 Inspection-Time-and-Material and Labor-Hour.

52.246-7 Inspection of Research and Development-Fixed-Price.

52.246-8 Inspection of Research and Development-Cost-Reimbursement.

52.246-9 Inspection of Research and Development (Short Form).

52.246-11 Higher-Level Contract Quality Requirement.

52.246-12 Inspection of Construction.

52.246-13 Inspection-Dismantling, Demolition, or Removal of Improvements.

52.246-14 Inspection of Transportation.

52.246-15 Certificate of Conformance.

52.246-16 Responsibility for Supplies.

52.246-17 Warranty of Supplies of a Noncomplex Nature.

52.246-18 Warranty of Supplies of a Complex Nature.

52.246-19 Warranty of Systems and Equipment under Performance Specifications or Design Criteria.

52.246-20 Warranty of Services.

52.246-21 Warranty of Construction.

52.246-23 Limitation of Liability.

52.246-24 Limitation of Liability-High-Value Items.

52.246-25 Limitation of Liability-Services.

52.246-26 Reporting Nonconforming Items.

52.247-1 Commercial Bill of Lading Notations.

52.247-2 Permits, Authorities, or Franchises.

52.247-3 Capability to Perform a Contract for the Relocation of a Federal Office.

52.247-4 Inspection of Shipping and Receiving Facilities.

52.247-5 Familiarization with Conditions.

52.247-8 Estimated Weights or Quantities Not Guaranteed.

52.247-9 Agreed Weight-General Freight.

52.247-10 Net Weight-General Freight.

52.247-11 Net Weight-Household Goods or Office Furniture.

52.247-12 Supervision, Labor, or Materials.

52.247-13 Accessorial Services-Moving Contracts.

52.247-14 Contractor Responsibility for Receipt of Shipment.

52.247-15 Contractor Responsibility for Loading and Unloading.

52.247-16 Contractor Responsibility for Returning Undelivered Freight.

52.247-19 Stopping in Transit for Partial Unloading.

52.247-20 Estimated Quantities or Weights for Evaluation of Offers.

52.247-21 Contractor Liability for Personal Injury and/or Property Damage.

52.247-22 Contractor Liability for Loss of and/or Damage to Freight other than Household Goods.

52.247-23 Contractor Liability for Loss of and/or Damage to Household Goods.

52.247-24 Advance Notification by the Government.

52.247-25 Government-Furnished Equipment With or Without Operators.

52.247-26 Government Direction and Marking.

52.247-27 Contract Not Affected by Oral Agreement.

52.247-28 Contractor’s Invoices.

52.247-30 F.o.b. Origin, Contractor’s Facility.

52.247-31 F.o.b. Origin, Freight Allowed.

52.247-32 F.o.b. Origin, Freight Prepaid.

52.247-33 F.o.b. Origin, with Differentials.

52.247-35 F.o.b. Destination, Within Consignee’s Premises.

52.247-36 F.a.s. Vessel, Port of Shipment.

52.247-37 F.o.b. Vessel, Port of Shipment.

52.247-38 F.o.b. Inland Carrier, Point of Exportation.

52.247-39 F.o.b. Inland Point, Country of Importation.

52.247-40 Ex Dock, Pier, or Warehouse, Port of Importation.

52.247-43 F.o.b. Designated Air Carrier’s Terminal, Point of Exportation.

52.247-44 F.o.b. Designated Air Carrier’s Terminal, Point of Importation.

52.247-45 F.o.b. Origin and/or F.o.b. Destination Evaluation.

52.247-46 Shipping Point(s) Used in Evaluation of F.o.b. Origin Offers.

52.247-47 Evaluation-F.o.b. Origin.

52.247-48 F.o.b. Destination-Evidence of Shipment.

52.247-49 Destination Unknown.

52.247-50 No Evaluation of Transportation Costs.

52.247-51 Evaluation of Export Offers.

52.247-53 Freight Classification Description.

52.247-55 F.o.b. Point for Delivery of Government-Furnished Property.

52.247-56 Transit Arrangements.

52.247-57 Transportation Transit Privilege Credits.

52.247-58 Loading, Blocking, and Bracing of Freight Car Shipments.

52.247-59 F.o.b. Origin-Carload and Truckload Shipments.

52.247-60 Guaranteed Shipping Characteristics.

52.247-61 F.o.b. Origin-Minimum Size of Shipments.

52.247-62 Specific Quantities Unknown.

52.247-63 Preference for U.S.-Flag Air Carriers.

52.247-64 Preference for Privately Owned U.S.-Flag Commercial Vessels.

52.247-65 F.o.b. Origin, Prepaid Freight-Small Package Shipments.

52.247-66 Returnable Cylinders.

52.247-67 Submission of Transportation Documents for Audit.

52.247-68 Report of Shipment (REPSHIP).

52.248-2 Value Engineering-Architect-Engineer.

52.248-3 Value Engineering-Construction.

52.249-1 Termination for Convenience of the Government (Fixed-Price) (Short Form).

52.249-2 Termination for Convenience of the Government (Fixed-Price).

52.249-4 Termination for Convenience of the Government (Services) (Short Form).

52.249-6 Termination (Cost-Reimbursement).

52.249-7 Termination (Fixed-Price Architect-Engineer).

52.249-8 Default (Fixed-Price Supply and Service).

52.249-9 Default (Fixed-Price Research and Development).

52.249-10 Default (Fixed-Price Construction).

52.249-12 Termination (Personal Services).

52.250-1 Indemnification Under Public Law85-804.

52.250-2 SAFETY Act Coverage Not Applicable.

52.250-3 SAFETY Act Block Designation/Certification.

52.250-4 SAFETY Act Pre-qualification Designation Notice.

52.250-5 SAFETY ActEquitable Adjustment.

52.251-1 Government Supply Sources.

52.251-2 Interagency Fleet Management System Vehicles and Related Services.

52.252-1 Solicitation Provisions Incorporated by Reference.

52.252-2 Clauses Incorporated by Reference.

52.252-3 Alterations in Solicitation.

52.252-4 Alterations in Contract.

52.252-5 Authorized Deviations in Provisions.

52.252-6 Authorized Deviations in Clauses.

52.253-1 Computer Generated Forms.

Subpart 52.3 - Provision and Clause Matrix

52.301 Solicitation provisions and contract clauses (Matrix).

52.000 Scope of part.

This part-

(a) Gives instructions for using provisions and clauses in solicitations and/or contracts;

(b) Sets forth the solicitation provisions and contract clauses prescribed by this regulation; and

(c) Presents a matrix listing the FAR provisions and clauses applicable to each principal contract type and/or purpose (e.g., fixed-price supply, cost-reimbursement research and development).

Subpart 52.1 - Instructions for Using Provisions and Clauses

52.100 Scope of subpart.

This subpart-

(a) Gives instructions for using part 52, including the explanation and use of provision and clause numbers, prescriptions, prefaces, and the matrix;

(b) Prescribes procedures for incorporating, identifying, and modifying provisions and clauses in solicitations and contracts, and for using alternates; and

(c) Describes the derivation of FAR provisions and clauses.

52.101 Using Part 52.

(a) Definition. "Modification," as used in this subpart, means a minor change in the details of a provision or clause that is specifically authorized by the FAR and does not alter the substance of the provision or clause (see 52.104).

(b) Numbering—

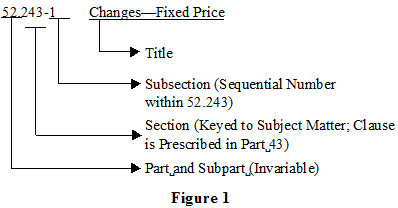

(1) FAR provisions and clauses. subpart 52.2 sets forth the text of all FAR provisions and clauses, each in its own separate subsection. The subpart is arranged by subject matter, in the same order as, and keyed to, the parts of the FAR. Each FAR provision or clause is uniquely identified. All FAR provision and clause numbers begin with "52.2," since the text of all FAR provisions and clauses appear in subpart 52.2. The next two digits of the provision or clause number correspond to the number of the FAR subject part in which the provision or clause is prescribed. The FAR provision or clause number is then completed by a hyphen and a sequential number assigned within each section of subpart 52.2. The following example illustrates the makeup of the FAR provision or clause number (see Figure 1 below).

(2) Provisions or clauses that supplement the FAR.

(i) Provisions or clauses that supplement the FAR are-

(A) Prescribed and included in authorized agency acquisition regulations issued within an agency to satisfy the specific needs of the agency as a whole;

(B) Prescribed and included in a regulation issued by a suborganization of an agency to satisfy the needs of that particular suborganization; or

(C) Developed for use at a suborganizational level of an agency, not meant for repetitive use, but intended to meet the needs of an individual acquisition and, thus, impractical to include in either an agency or suborganization acquisition regulation. (See 1.301(c).)

(ii) Supplemental provisions or clauses published in agency acquisition regulations shall be in full text and the prescription for the use of each shall be included. Supplemental provisions or clauses published in agency acquisition regulations shall be numbered in the same manner in which FAR provisions and clauses are numbered except that-

(A) If it is included in an agency acquisition regulation that is published in the Federal Register and is codified in Title 48, Code of Federal Regulations (48 CFR), the number shall be preceded by the chapter number within 48 CFR assigned by the CFR staff; and

(B) The sequential number shall be "70" or a higher number (see 1.303).

(iii) The sequential number at the end of the number of a provision or clause that supplements the FAR, like its counterpart at the end of any FAR provision or clause number, indicates the subsection location of the provision or clause in subpart 52.2 of the agency acquisition regulation that contains its full text. If, for example, an agency acquisition regulation contains only one provision followed by only one clause supplementing the FAR in its section 52.236 (Construction and Architect-Engineer Contracts), then the sequential numbers would be "70" for the provision and "71" for the clause.

(c) Prescriptions. Each provision or clause in subpart 52.2 is prescribed at that place in the FAR text where the subject matter of the provision or clause receives its primary treatment. The prescription includes all conditions, requirements, and instructions for using the provision or clause and its alternates, if any. The provision or clause may be referred to in other FAR locations.

(d) Introductory text. Within subpart 52.2, the introductory text of each provision or clause includes a cross-reference to the location in the FAR subject text that prescribes its use.

(e) Matrix.

(1) The matrix may be accessed via the internet at https://www.acquisition.gov/smart-matrix. The matrix contains a column for each principal type and/or purpose of contract ( e.g., fixed-price supply, cost reimbursement research and development). The matrix lists the—

(i) Required solicitation provisions;

(ii) Required-when-applicable solicitation provisions;

(iii) Optional solicitation provisions;

(iv) Required contract clauses;

(v) Required-when-applicable contract clauses; and

(vi) Optional contract clauses.

(2) For each provision or clause listed, the matrix provides information on-

(i) Whether incorporation by reference is or is not authorized (see 52.102);

(ii) The section of the Uniform Contract Format (UCF) in which it is to be located, if it is used in an acquisition that is subject to the UCF;

(iii) Its number;

(iv) The citation of the FAR text that prescribes its use; and

(v) Its title.

(3) Since the matrix does not provide sufficient information to determine the applicability of a provision or clause in the "required-when-applicable" and "optional" categories, contracting officers shall refer to the FAR text (cited in the matrix) that prescribes its use.

(4) The FAR matrix may be reproduced at agency levels, and at subordinate levels, for the purpose of supplementing it with agency-developed provisions and clauses. The resulting consolidated matrices may be included in agency acquisition regulations.

(f) Dates. Since they are subject to revision from time to time, all provisions, clauses, and alternates are dated; e.g.,(Dec 1983). To avoid questions concerning which version of any provision, clause, or alternate is operative in any given solicitation or contract, its date shall be included whether it is incorporated by reference or in full text.

52.102 Incorporating provisions and clauses.

(a) Provisions and clauses should be incorporated by reference to the maximum practical extent, rather than being incorporated in full text, even if they-

(1) Are used with one or more alternates or on an optional basis;

(2) Are prescribed on a "substantially as follows" or "substantially the same as" basis, provided they are used verbatim;

(3) Require modification or the insertion by the Government of fill-in material (see 52.104); or

(4) Require completion by the offeror or prospective contractor. This instruction also applies to provisions completed as annual representations and certifications.

(b) Except for provisions and clauses prescribed in 52.107, any provision or clause that can be accessed electronically by the offeror or prospective contractor may be incorporated by reference in solicitations and/or contracts. However, the contracting officer, upon request, shall provide the full text of any provision or clause incorporated by reference.

(c) Agency approved provisions and clauses prescribed in agency acquisition regulations, and FAR provisions and clauses not authorized to be incorporated by reference as shown in the matrix at https://www.acquisition.gov/smart-matrix, need not be incorporated in full text, provided the contracting officer includes in the solicitation and contract a statement that—

(1) Identifies all provisions and clauses that require completion by the offeror or prospective contractor;

(2) Specifies that the provisions and clauses must be completed by the offeror or prospective contractor and must be submitted with the quotation or offer; and

(3) Identifies to the offeror or prospective contractor at least one electronic address where the full text may be accessed.

(d) An agency may develop a group listing of provisions and clauses that apply to a specific category of contracts. An agency group listing may be incorporated by reference in solicitations and/or contracts in lieu of citing the provisions and clauses individually, provided the group listing is made available electronically to offerors and prospective contractors.

(e) A provision or clause that is not available electronically to offerors and prospective contractors shall be incorporated in solicitations and/or contracts in full text if it is-

(1) A FAR provision or clause that otherwise is not authorized to be incorporated by reference (see sub part 52.3); or

(2) A provision or clause prescribed for use in an agency acquisition regulation.

(f) Provisions or clauses may not be incorporated by reference by being listed in the-

(1) Provision at 52.252-3, Alterations in Solicitations; or

(2) Clause at 52.252-4, Alterations in Contract.

52.103 Identification of provisions and clauses.

(a) Whenever any FAR provision or clause is used without deviation in a solicitation or contract, whether it is incorporated by reference or in full text, it shall be identified by number, title, and date. This identification shall also be used if the FAR provision or clause is used with an authorized deviation, except that the contracting officer shall then insert "(DEVIATION)" after the date. Solicited firms and contractors will be advised of the meaning of this insertion through the use of the (1) provision at 52.252-5, Authorized Deviations in Provisions, or (2) clause at 52.252-6, Authorized Deviations in Clauses. The above mentioned provision and clause are prescribed in 52.107(e) and (f).

(b) Any provision or clause that supplements the FAR whether it is incorporated by reference or in full text shall be clearly identified by number, title, date, and name of the regulation. When a supplemental provision or clause is used with an authorized deviation, insert "(DEVIATION)" after the name of the regulation.

(c) A provision or clause of the type described in 52.101(b)(2)(i)(C) shall be identified by the title, date, and the name of the agency or suborganization within the agency that developed it.

(d) Except for provisions or clauses covered by 52.103(c), the following hypothetical examples illustrate how a provision or clause that supplements the FAR shall be identified when it is incorporated in solicitations and/or contracts by reference or in full text:

(1) If part 14 (Sealed Bidding) of the X Agency Acquisition Regulation, published in the Federal Register and codified as Chapter 99 in 48 CFR, prescribes the use of a provision entitled "Bid Envelopes," dated October 1983, and that provision is sequentially the first provision or clause appearing in Section 52.214 of the X Agency Acquisition Regulation, then the identification of that provision shall be "9952.214-70-Bid Envelopes (Oct 1983)."

(2) Assume that Y, a major organizational element of the X Agency, is authorized to issue the Y Acquisition Regulation, which is not published in the Federal Register and codified in 48 CFR. If part 36 (Construction and Architect-Engineer Contracts) of the Y Acquisition Regulation prescribes the use of a clause entitled "Refrigerated Display Cases," dated March 1983, pertaining to a specialized type of construction work, and that clause is sequentially the second provision or clause appearing in Section 52.236 of the Y Acquisition Regulation, then the identification of that clause shall be "52.236-71-Refrigerated Display Cases (Mar 1983)-Y Acquisition Regulation."

52.104 Procedures for modifying and completing provisions and clauses.

(a) The contracting officer must not modify provisions and clauses unless the FAR authorizes their modification. For example-

(1) "The contracting officer may use a period shorter than 60 days (but not less than 30 days) in paragraph (x) of the clause"; or

(2) "The contracting officer may substitute the words ‘task order’ for the word ‘Schedule’ wherever that word appears in the clause."

(b) When modifying provisions or clauses incorporated by reference, insert the changed wording directly below the title of the provision or clause identifying to the lowest level necessary (e.g., paragraph, sentence, word), to clearly indicate what is being modified.

(c) When modifying provisions or clauses incorporated in full text, modify the language directly by substituting the changed wording as permitted.

(d) When completing blanks in provisions or clauses incorporated by reference, insert the fill-in information directly below the title of the provision or clause identifying to the lowest level necessary to clearly indicate the blanks being filled in.

(e) When completing blanks in provisions or clauses incorporated in full text, insert the fill-in information in the blanks of the provision or clause.

52.105 Procedures for using alternates.

(a) The FAR accommodates a major variation in a provision or clause by use of an alternate. The FAR prescribes alternates to a given provision or clause in the FAR subject text where the provision or clause is prescribed. The alternates to each provision or clause are titled "Alternate I," "Alternate II," "Alternate III," etc.

(b) When an alternate is used, its date shall be cited along with the date of the basic provision or clause; e.g., 52.209-3 First Article Approval-Contractor Testing (Oct 1983)-Alternate I (Dec 1983).

(c) Under certain circumstances, a provision or clause may be used with two or more alternates. In these circumstances, each of the applicable alternates shall be cited, whether incorporated by reference or in full text; e.g., 52.209-3 First Article Approval-Contractor Testing (Oct 1983)-Alternate I (Dec 1983) and Alternate II (Feb 1984). However, under no circumstances may an alternate to a specific provision or clause be applied to any other provision or clause.

52.106 [Reserved]

52.107 Provisions and clauses prescribed in subpart 52.1.

(a) The contracting officer shall insert the provision at 52.252-1, Solicitation Provisions Incorporated by Reference, in solicitations in order to incorporate provisions by reference.

(b) The contracting officer shall insert the clause at 52.252-2, Clauses Incorporated by Reference, in solicitations and contracts in order to incorporate clauses by reference.

(c) The contracting officer shall insert the provision at 52.252-3, Alterations in Solicitation, in solicitations in order to revise or supplement, as necessary, other parts of the solicitation that apply to the solicitation phase only, except for any provision authorized for use with a deviation.

(d) The contracting officer shall insert the clause at 52.252-4, Alterations in Contract, in solicitations and contracts in order to revise or supplement, as necessary, other parts of the contract, or parts of the solicitations that apply to the contract phase, except for any clause authorized for use with a deviation.

(e) The contracting officer shall insert the provision at 52.252-5, Authorized Deviations in Provisions, in solicitations that include any FAR or supplemental provision with an authorized deviation. Whenever any FAR or supplemental provision is used with an authorized deviation, the contracting officer shall identify it by the same number, title, and date assigned to the provision when it is used without deviation, include regulation name for any supplemental provision, except that the contracting officer shall insert "(DEVIATION)" after the date of the provision.

(f) The contracting officer shall insert the clause at 52.252-6, Authorized Deviations in Clauses, in solicitations and contracts that include any FAR or supplemental clause with an authorized deviation. Whenever any FAR or supplemental clause is used with an authorized deviation, the contracting officer shall identify it by the same number, title, and date assigned to the clause when it is used without deviation, include regulation name for any supplemental clause, except that the contracting officer shall insert "(DEVIATION)" after the date of the clause.

Subpart 52.2 - Text of Provisions and Clauses

52.200 Scope of subpart.

This subpart sets forth the text of all FAR provisions and clauses (see 52.101(b)(1)) and gives a cross-reference to the location in the FAR that prescribes the provision or clause.

52.201 [Reserved]

52.201-1 Acquisition 360: Voluntary Survey.

As prescribed in 1.102-3(b), insert the following provision:

Acquisition 360: Voluntary Survey (Sep 2023)

(a)All actual and potential offerors are encouraged to provide feedback on the preaward and debriefing processes, as applicable. Feedback may be provided to agencies up to 45 days after award. The feedback is anonymous, unless the participant self-identifies in the survey. Actual and potential offerors can participate in the survey by selecting the following link: https://www.acquisition.gov/360.

(b)The Contracting Officer will not review the information provided until after contract award and will not consider it in the award decision. The survey is voluntary and does not convey any protections, rights, or grounds for protest. It creates a way for actual and potential offerors to provide the Government constructive feedback about the preaward and debriefing processes, as applicable, used for a specific acquisition.

(End of provision)

52.202 [Reserved]

52.202-1 Definitions.

As prescribed in 2.201 , insert the following clause:

Definitions (Jun 2020)

When a solicitation provision or contract clause uses a word or term that is defined in the Federal Acquisition Regulation (FAR), the word or term has the same meaning as the definition in FAR 2.101 in effect at the time the solicitation was issued, unless-

(a) The solicitation, or amended solicitation, provides a different definition;

(b) The contracting parties agree to a different definition;

(c) The part, subpart, or section of the FAR where the provision or clause is prescribed provides a different meaning;

(d) The word or term is defined in FAR part 31, for use in the cost principles and procedures; or

(e) The word or term defines an acquisition-related threshold, and if the threshold is adjusted for inflation as set forth in FAR 1.109(a), then the changed threshold applies throughout the remaining term of the contract, unless there is a subsequent threshold adjustment; see FAR 1.109(d).

(End of clause)

52.203 [Reserved]

52.203-1 [Reserved]

52.203-2 Certificate of Independent Price Determination.

As prescribed in 3.103-1 , insert the following provision. If the solicitation is a Request for Quotations, the terms "Quotation" and "Quoter" may be substituted for "Offer" and "Offeror."

Certificate of Independent Price Determination (Apr 1985)

(a) The offeror certifies that-

(1) The prices in this offer have been arrived at independently, without, for the purpose of restricting competition, any consultation, communication, or agreement with any other offeror or competitor relating to-

(i) Those prices;

(ii) The intention to submit an offer; or

(iii) The methods or factors used to calculate the prices offered.

(2) The prices in this offer have not been and will not be knowingly disclosed by the offeror, directly or indirectly, to any other offeror or competitor before bid opening (in the case of a sealed bid solicitation) or contract award (in the case of a negotiated solicitation) unless otherwise required by law; and

(3) No attempt has been made or will be made by the offeror to induce any other concern to submit or not to submit an offer for the purpose of restricting competition.

(b) Each signature on the offer is considered to be a certification by the signatory that the signatory-

(1) Is the person in the offeror’s organization responsible for determining the prices being offered in this bid or proposal, and that the signatory has not participated and will not participate in any action contrary to paragraphs (a)(1) through (a)(3) of this provision; or

(2)

(i) Has been authorized, in writing, to act as agent for the following principals in certifying that those principals have not participated, and will not participate in any action contrary to paragraphs (a)(1) through (a)(3) of this provision ____________ [insert full name of person(s) in the offeror’s organization responsible for determining the prices offered in this bid or proposal, and the title of his or her position in the offeror’s organization];

(ii) As an authorized agent, does certify that the principals named in subdivision (b)(2)(i) of this provision have not participated, and will not participate, in any action contrary to paragraphs (a)(1) through (a)(3) of this provision; and

(iii) As an agent, has not personally participated, and will not participate, in any action contrary to paragraphs (a)(1) through (a)(3) of this provision.

(c) If the offeror deletes or modifies subparagraph (a)(2) above, the offeror must furnish with its offer a signed statement setting forth in detail the circumstances of the disclosure.

(End of provision)

52.203-3 Gratuities.

As prescribed in 3.202 , insert the following clause:

Gratuities (Apr 1984)

(a) The right of the Contractor to proceed may be terminated by written notice if, after notice and hearing, the agency head or a designee determines that the Contractor, its agent, or another representative-

(1) Offered or gave a gratuity (e.g., an entertainment or gift) to an officer, official, or employee of the Government; and

(2) Intended, by the gratuity, to obtain a contract or favorable treatment under a contract.

(b) The facts supporting this determination may be reviewed by any court having lawful jurisdiction.

(c) If this contract is terminated under paragraph (a) of this clause, the Government is entitled-

(1) To pursue the same remedies as in a breach of the contract; and

(2) In addition to any other damages provided by law, to exemplary damages of not less than 3 nor more than 10 times the cost incurred by the Contractor in giving gratuities to the person concerned, as determined by the agency head or a designee. (This paragraph (c)(2) is applicable only if this contract uses money appropriated to the Department of Defense.)

(d) The rights and remedies of the Government provided in this clause shall not be exclusive and are in addition to any other rights and remedies provided by law or under this contract.

(End of clause)

52.203-4 [Reserved]

52.203-5 Covenant Against Contingent Fees.

As prescribed in 3.404 , insert the following clause:

Covenant Against Contingent Fees (May 2014)

(a) The Contractor warrants that no person or agency has been employed or retained to solicit or obtain this contract upon an agreement or understanding for a contingent fee, except a bona fide employee or agency. For breach or violation of this warranty, the Government shall have the right to annul this contract without liability or, to deduct from the contract price or consideration, or otherwise recover, the full amount of the contingent fee.

(b) "Bona fide agency," as used in this clause, means an established commercial or selling agency, maintained by a contractor for the purpose of securing business, that neither exerts nor proposes to exert improper influence to solicit or obtain Government contracts nor holds itself out as being able to obtain any Government contract or contracts through improper influence.

Bona fide employee, as used in this clause, means a person, employed by a contractor and subject to the contractor’s supervision and control as to time, place, and manner of performance, who neither exerts nor proposes to exert improper influence to solicit or obtain Government contracts nor holds out as being able to obtain any Government contract or contracts through improper influence.

Contingent fee, as used in this clause, means any commission, percentage, brokerage, or other fee that is contingent upon the success that a person or concern has in securing a Government contract.

Improper influence, as used in this clause, means any influence that induces or tends to induce a Government employee or officer to give consideration or to act regarding a Government contract on any basis other than the merits of the matter.

(End of clause)

52.203-6 Restrictions on Subcontractor Sales to the Government.

As prescribed in 3.503-2 , insert the following clause:

Restrictions on Subcontractor Sales to the Government (Jun 2020)

(a) Except as provided in (b) of this clause, the Contractor shall not enter into any agreement with an actual or prospective subcontractor, nor otherwise act in any manner, which has or may have the effect of restricting sales by such subcontractors directly to the Government of any item or process (including computer software) made or furnished by the subcontractor under this contract or under any follow-on production contract.

(b) The prohibition in (a) of this clause does not preclude the Contractor from asserting rights that are otherwise authorized by law or regulation.

(c) The Contractor agrees to incorporate the substance of this clause, including this paragraph (c), in all subcontracts under this contract which exceed the simplified acquisition threshold, as defined in Federal Acquisition Regulation 2.101 on the date of subcontract award.

(End of clause)

Alternate I (Nov 2021). As prescribed in 3.503-2 , substitute the following paragraph in place of paragraph (b) of the basic clause:

(b) The prohibition in paragraph (a) of this clause does not preclude the Contractor from asserting rights that are otherwise authorized by law or regulation. For acquisitions of commercial products or commercial services). the prohibition in paragraph (a) applies only to the extent that any agreement restricting sales by subcontractors results in the Federal Government being treated differently from any other prospective purchaser for the sale of the commercial product(s) and commercial service(s).

52.203-7 Anti-Kickback Procedures.

As prescribed in 3.502-3 , insert the following clause:

Anti-Kickback Procedures (Jun 2020)

(a) Definitions.

Kickback, as used in this clause, means any money, fee, commission, credit, gift, gratuity, thing of value, or compensation of any kind which is provided to any prime Contractor, prime Contractor employee, subcontractor, or subcontractor employee for the purpose of improperly obtaining or rewarding favorable treatment in connection with a prime contract or in connection with a subcontract relating to a prime contract.

Person, as used in this clause, means a corporation, partnership, business association of any kind, trust, joint-stock company, or individual.

Prime contract, as used in this clause, means a contract or contractual action entered into by the United States for the purpose of obtaining supplies, materials, equipment, or services of any kind.

Prime Contractor as used in this clause, means a person who has entered into a prime contract with the United States.

Prime Contractor employee, as used in this clause, means any officer, partner, employee, or agent of a prime Contractor.

Subcontract, as used in this clause, means a contract or contractual action entered into by a prime Contractor or subcontractor for the purpose of obtaining supplies, materials, equipment, or services of any kind under a prime contract.

Subcontractor, as used in this clause, (1) means any person, other than the prime Contractor, who offers to furnish or furnishes any supplies, materials, equipment, or services of any kind under a prime contract or a subcontract entered into in connection with such prime contract, and (2) includes any person who offers to furnish or furnishes general supplies to the prime Contractor or a higher tier subcontractor.

Subcontractor employee, as used in this clause, means any officer, partner, employee, or agent of a subcontractor.

(b) 41 U.S.C. chapter 87, Kickbacks, prohibits any person from-

(1) Providing or attempting to provide or offering to provide any kickback;

(2) Soliciting, accepting, or attempting to accept any kickback; or

(3) Including, directly or indirectly, the amount of any kickback in the contract price charged by a prime Contractor to the United States or in the contract price charged by a subcontractor to a prime Contractor or higher tier subcontractor.

(c)

(1) The Contractor shall have in place and follow reasonable procedures designed to prevent and detect possible violations described in paragraph (b) of this clause in its own operations and direct business relationships.

(2) When the Contractor has reasonable grounds to believe that a violation described in paragraph (b) of this clause may have occurred, the Contractor shall promptly report in writing the possible violation. Such reports shall be made to the inspector general of the contracting agency, the head of the contracting agency if the agency does not have an inspector general, or the Attorney General.

(3) The Contractor shall cooperate fully with any Federal agency investigating a possible violation described in paragraph (b) of this clause.

(4) The Contracting Officer may (i) offset the amount of the kickback against any monies owed by the United States under the prime contract and/or (ii) direct that the Prime Contractor withhold from sums owed a subcontractor under the prime contract the amount of the kickback. The Contracting Officer may order that monies withheld under subdivision (c)(4)(ii) of this clause be paid over to the Government unless the Government has already offset those monies under subdivision (c)(4)(i) of this clause. In either case, the Prime Contractor shall notify the Contracting Officer when the monies are withheld.

(5) The Contractor agrees to incorporate the substance of this clause, including this paragraph (c)(5) but excepting paragraph (c)(1) of this clause, in all subcontracts under this contract that exceed the threshold specified in Federal Acquisition Regulation 3.502-2(i) on the date of subcontract award.

(End of clause)

52.203-8 Cancellation, Rescission, and Recovery of Funds for Illegal or Improper Activity.

As prescribed in 3.104-9(a), insert the following clause:

Cancellation, Rescission, and Recovery of Funds for Illegal or Improper Activity (May 2014)

(a) If the Government receives information that a contractor or a person has violated 41 U.S.C. 2102- 2104, Restrictions on Obtaining and Disclosing Certain Information, the Government may-

(1) Cancel the solicitation, if the contract has not yet been awarded or issued; or

(2) Rescind the contract with respect to which-

(i) The Contractor or someone acting for the Contractor has been convicted for an offense where the conduct violates 41 U.S.C.2102 for the purpose of either-

(A) Exchanging the information covered by such subsections for anything of value; or

(B) Obtaining or giving anyone a competitive advantage in the award of a Federal agency procurement contract; or

(ii) The head of the contracting activity has determined, based upon a preponderance of the evidence, that the Contractor or someone acting for the Contractor has engaged in conduct punishable under 41 U.S.C. 2105(a).

(b) If the Government rescinds the contract under paragraph (a) of this clause, the Government is entitled to recover, in addition to any penalty prescribed by law, the amount expended under the contract.

(c) The rights and remedies of the Government specified herein are not exclusive, and are in addition to any other rights and remedies provided by law, regulation, or under this contract.

(End of clause)

52.203-9 [Reserved]

52.203-10 Price or Fee Adjustment for Illegal or Improper Activity.

As prescribed in 3.104-9(b), insert the following clause:

Price or Fee Adjustment for Illegal or Improper Activity (May 2014)

(a) The Government, at its election, may reduce the price of a fixed-price type contract and the total cost and fee under a cost-type contract by the amount of profit or fee determined as set forth in paragraph (b) of this clause if the head of the contracting activity or designee determines that there was a violation of 41 U.S.C.2102 or 2103, as implemented in section 3.104 of the Federal Acquisition Regulation.

(b) The price or fee reduction referred to in paragraph (a) of this clause shall be-

(1) For cost-plus-fixed-fee contracts, the amount of the fee specified in the contract at the time of award;

(2) For cost-plus-incentive-fee contracts, the target fee specified in the contract at the time of award, notwithstanding any minimum fee or "fee floor" specified in the contract;

(3) For cost-plus-award-fee contracts-

(i) The base fee established in the contract at the time of contract award;

(ii) If no base fee is specified in the contract, 30 percent of the amount of each award fee otherwise payable to the Contractor for each award fee evaluation period or at each award fee determination point.

(4) For fixed-price-incentive contracts, the Government may-

(i) Reduce the contract target price and contract target profit both by an amount equal to the initial target profit specified in the contract at the time of contract award; or

(ii) If an immediate adjustment to the contract target price and contract target profit would have a significant adverse impact on the incentive price revision relationship under the contract, or adversely affect the contract financing provisions, the Contracting Officer may defer such adjustment until establishment of the total final price of the contract. The total final price established in accordance with the incentive price revision provisions of the contract shall be reduced by an amount equal to the initial target profit specified in the contract at the time of contract award and such reduced price shall be the total final contract price.

(5) For firm-fixed-price contracts, by 10 percent of the initial contract price or a profit amount determined by the Contracting Officer from records or documents in existence prior to the date of the contract award.

(c) The Government may, at its election, reduce a prime contractor’s price or fee in accordance with the procedures of paragraph (b) of this clause for violations of the statute by its subcontractors by an amount not to exceed the amount of profit or fee reflected in the subcontract at the time the subcontract was first definitively priced.

(d) In addition to the remedies in paragraphs (a) and (c) of this clause, the Government may terminate this contract for default. The rights and remedies of the Government specified herein are not exclusive, and are in addition to any other rights and remedies provided by law or under this contract.

(End of clause)

52.203-11 Certification and Disclosure Regarding Payments to Influence Certain Federal Transactions.

As prescribed in 3.808(a), insert the following provision:

Certification and Disclosure Regarding Payments to Influence Certain Federal Transactions (Sep 2024)

(a) Definitions. As used in this provision-"Lobbying contact" has the meaning provided at 2 U.S.C. 1602(8). The terms "agency," "influencing or attempting to influence," "officer or employee of an agency," "person," "reasonable compensation," and "regularly employed" are defined in the FAR clause of this solicitation entitled "Limitation on Payments to Influence Certain Federal Transactions" ( 52.203-12).

(b) Prohibition. The prohibition and exceptions contained in the FAR clause of this solicitation entitled "Limitation on Payments to Influence Certain Federal Transactions" ( 52.203-12) are hereby incorporated by reference in this provision.

(c) Certification. The offeror, by signing its offer, hereby certifies to the best of its knowledge and belief that no Federal appropriated funds have been paid or will be paid to any person for influencing or attempting to influence an officer or employee of any agency, a Member of Congress, an officer or employee of Congress, or an employee of a Member of Congress on its behalf in connection with the awarding of this contract.

(d) Disclosure. If any registrants under the Lobbying Disclosure Act of 1995 have made a lobbying contact on behalf of the offeror with respect to this contract, the offeror shall complete and submit, with its offer, OMB Standard Form LLL, Disclosure of Lobbying Activities, to provide the name of the registrants. The offeror need not report regularly employed officers or employees of the offeror to whom payments of reasonable compensation were made.

(e) Penalty. Submission of this certification and disclosure is a prerequisite for making or entering into this contract imposed by 31 U.S.C. 1352. Any person who makes an expenditure prohibited under this provision or who fails to file or amend the disclosure required to be filed or amended by this provision, shall be subject to civil penalties as provided in 31 U.S.C. 1352. An imposition of a civil penalty does not prevent the Government from seeking any other remedy that may be applicable.

(End of provision)

52.203-12 Limitation on Payments to Influence Certain Federal Transactions.

As prescribed in 3.808(b), insert the following clause:

Limitation on Payments to Influence Certain Federal Transactions (Jun 2020)

(a) Definitions. As used in this clause-

Agency means "executive agency" as defined in Federal Acquisition Regulation (FAR) 2.101.

Covered Federal action means any of the following actions:

(1) Awarding any Federal contract.

(2) Making any Federal grant.

(3) Making any Federal loan.

(4) Entering into any cooperative agreement.

(5) Extending, continuing, renewing, amending, or modifying any Federal contract, grant, loan, or cooperative agreement.

Indian tribe and "tribal organization" have the meaning provided in section 4 of the Indian Self-Determination and Education Assistance Act ( 25 U.S.C. 450b) and include Alaskan Natives.

Influencing or attempting to influence means making, with the intent to influence, any communication to or appearance before an officer or employee of any agency, a Member of Congress, an officer or employee of Congress, or an employee of a Member of Congress in connection with any covered Federal action.

Local government means a unit of government in a State and, if chartered, established, or otherwise recognized by a State for the performance of a governmental duty, including a local public authority, a special district, an intrastate district, a council of governments, a sponsor group representative organization, and any other instrumentality of a local government.

Officer or employee of an agency includes the following individuals who are employed by an agency:

(1) An individual who is appointed to a position in the Government under Title 5, United States Code, including a position under a temporary appointment.

(2) A member of the uniformed services, as defined in subsection 101(3), Title 37, United States Code.

(3) A special Government employee, as defined in section 202, Title 18, United States Code.

(4) An individual who is a member of a Federal advisory committee, as defined by the Federal Advisory Committee Act, Title 5, United States Code, appendix 2.

Person means an individual, corporation, company, association, authority, firm, partnership, society, State, and local government, regardless of whether such entity is operated for profit, or not for profit. This term excludes an Indian tribe, tribal organization, or any other Indian organization eligible to receive Federal contracts, grants, cooperative agreements, or loans from an agency, but only with respect to expenditures by such tribe or organization that are made for purposes specified in paragraph (b) of this clause and are permitted by other Federal law.

Reasonable compensation means, with respect to a regularly employed officer or employee of any person, compensation that is consistent with the normal compensation for such officer or employee for work that is not furnished to, not funded by, or not furnished in cooperation with the Federal Government.

Reasonable payment means, with respect to professional and other technical services, a payment in an amount that is consistent with the amount normally paid for such services in the private sector.

Recipient includes the Contractor and all subcontractors. This term excludes an Indian tribe, tribal organization, or any other Indian organization eligible to receive Federal contracts, grants, cooperative agreements, or loans from an agency, but only with respect to expenditures by such tribe or organization that are made for purposes specified in paragraph (b) of this clause and are permitted by other Federal law.

Regularly employed means, with respect to an officer or employee of a person requesting or receiving a Federal contract, an officer or employee who is employed by such person for at least 130 working days within 1 year immediately preceding the date of the submission that initiates agency consideration of such person for receipt of such contract. An officer or employee who is employed by such person for less than 130 working days within 1 year immediately preceding the date of the submission that initiates agency consideration of such person shall be considered to be regularly employed as soon as he or she is employed by such person for 130 working days.

State means a State of the United States, the District of Columbia, or an outlying area of the United States, an agency or instrumentality of a State, and multi-State, regional, or interstate entity having governmental duties and powers.

(b) Prohibition. 31 U.S.C. 1352 prohibits a recipient of a Federal contract, grant, loan, or cooperative agreement from using appropriated funds to pay any person for influencing or attempting to influence an officer or employee of any agency, a Member of Congress, an officer or employee of Congress, or an employee of a Member of Congress in connection with any covered Federal actions. In accordance with 31 U.S.C. 1352 the Contractor shall not use appropriated funds to pay any person for influencing or attempting to influence an officer or employee of any agency, a Member of Congress, an officer or employee of Congress, or an employee of a Member of Congress in connection with the award of this contractor the extension, continuation, renewal, amendment, or modification of this contract.

(1) The term appropriated funds does not include profit or fee from a covered Federal action.

(2) To the extent the Contractor can demonstrate that the Contractor has sufficient monies, other than Federal appropriated funds, the Government will assume that these other monies were spent for any influencing activities that would be unallowable if paid for with Federal appropriated funds.

(c) Exceptions. The prohibition in paragraph (b) of this clause does not apply under the following conditions:

(1) Agency and legislative liaison by Contractor employees.

(i) Payment of reasonable compensation made to an officer or employee of the Contractor if the payment is for agency and legislative liaison activities not directly related to this contract. For purposes of this paragraph, providing any information specifically requested by an agency or Congress is permitted at any time.

(ii) Participating with an agency in discussions that are not related to a specific solicitation for any covered Federal action, but that concern-

(A) The qualities and characteristics (including individual demonstrations) of the person’s products or services, conditions or terms of sale, and service capabilities; or

(B) The application or adaptation of the person’s products or services for an agency’s use.

(iii) Providing prior to formal solicitation of any covered Federal action any information not specifically requested but necessary for an agency to make an informed decision about initiation of a covered Federal action;

(iv) Participating in technical discussions regarding the preparation of an unsolicited proposal prior to its official submission; and

(v) Making capability presentations prior to formal solicitation of any covered Federal action by persons seeking awards from an agency pursuant to the provisions of the Small Business Act, as amended by Pub. L. 95-507, and subsequent amendments.

(2) Professional and technical services.

(i) A payment of reasonable compensation made to an officer or employee of a person requesting or receiving a covered Federal action or an extension, continuation, renewal, amendment, or modification of a covered Federal action, if payment is for professional or technical services rendered directly in the preparation, submission, or negotiation of any bid, proposal, or application for that Federal action or for meeting requirements imposed by or pursuant to law as a condition for receiving that Federal action.

(ii) Any reasonable payment to a person, other than an officer or employee of a person requesting or receiving a covered Federal action or an extension, continuation, renewal, amendment, or modification of a covered Federal action if the payment is for professional or technical services rendered directly in the preparation, submission, or negotiation of any bid, proposal, or application for that Federal action or for meeting requirements imposed by or pursuant to law as a condition for receiving that Federal action. Persons other than officers or employees of a person requesting or receiving a covered Federal action include consultants and trade associations.

(iii) As used in paragraph (c)(2) of this clause, "professional and technical services" are limited to advice and analysis directly applying any professional or technical discipline (for examples, see FAR 3.803(a)(2)(iii)).

(iv) Requirements imposed by or pursuant to law as a condition for receiving a covered Federal award include those required by law or regulation and any other requirements in the actual award documents.

(3) Only those communications and services expressly authorized by paragraphs (c)(1) and (2) of this clause are permitted.

(d) Disclosure.

(1) If the Contractor did not submit OMB Standard Form LLL, Disclosure of Lobbying Activities, with its offer, but registrants under the Lobbying Disclosure Act of 1995 have subsequently made a lobbying contact on behalf of the Contractor with respect to this contract, the Contractor shall complete and submit OMB Standard Form LLL to provide the name of the lobbying registrants, including the individuals performing the services.

(2) If the Contractor did submit OMB Standard Form LLL disclosure pursuant to paragraph (d) of the provision at FAR 52.203-11, Certification and Disclosure Regarding Payments to Influence Certain Federal Transactions, and a change occurs that affects Block 10 of the OMB Standard Form LLL (name and address of lobbying registrant or individuals performing services), the Contractor shall, at the end of the calendar quarter in which the change occurs, submit to the Contracting Officer within 30 days an updated disclosure using OMB Standard Form LLL.

(e) Penalties.

(1) Any person who makes an expenditure prohibited under paragraph (b) of this clause or who fails to file or amend the disclosure to be filed or amended by paragraph (d) of this clause shall be subject to civil penalties as provided for by 31 U.S.C. 1352. An imposition of a civil penalty does not prevent the Government from seeking any other remedy that may be applicable.

(2) Contractors may rely without liability on the representation made by their subcontractors in the certification and disclosure form.