Appendix - EE DEPARTMENT OF THE ARMY GOVERNMENT PURCHASE CARD OPERATING PROCEDURES

The official AFARS regulation resides on the Army’s Knowledge Management Portal PAM. If you do not have CAC access to PAM, please visit the Army Contracting Enterprise’s public facing website “Army Connect” at https://www.army.mil/armycontracting#org-afars. The AFARS will return to Acquisition.gov upon completion of the RFO.

(Revised 01 October 2024)

CHAPTER 1 - THE GOVERNMENT PURCHASE CARD PROGRAM

1-3. Information and Waiver Process

1-4. Task Order and Period of Performance

1-7. Micro-purchase Thresholds (MPT)

1-8. GPC Delegations of Authority and Appointment Letters

CHAPTER 2 - PROGRAM ORGANIZATION, ROLES, AND RESPONSIBILITIES

2-1. Responsibilities and Governmental Functions

2-2. Program Hierarchy Structure and Roles and Responsibilities

2-3. Component Program Manager (Level 2 A/OPC) Duties and Responsibilities

2-4. Primary and Alternate Level 3 A/OPC Duties and Responsibilities

2-5. Primary and Alternate Level 4 A/OPC Duties and Responsibilities

2-6. Primary and Alternate Level 5 - Billing Official Duties and Responsibilities

2-7. Level 6 - Cardholder Duties and Responsibilities

2-8. GPC Support Function Duties

2-9. Management of the GPC Program

CHAPTER 3 - GPC ELECTRONIC SYSTEMS

3-2. Procurement Integrated Enterprise Environment (PIEE)

3-3. Joint Appointment Module (JAM)

3-4. U.S. Bank Access Online (AXOL)

3-5. MasterCard Insights on Demand (IOD)

3-6. Global Exchange Service (GEX)

3-7. Total System Services Payment Solutions (TSYS)

3-8. Enterprise Resource Planning (ERP)

3-9. Federal Procurement Data System – Next Generation (FPDS-NG)

3-10. Wide Area Workflow (WAWF)

3-11. Procurement.army.mil (PAM) Portal

CHAPTER 4 - GPC TRAINING REQUIREMENTS

CHAPTER 5 - ESTABLISHING AND MAINTAINING A GPC ACCOUNT

5-1. Nomination, Selection, and Appointment of Cardholders and Billing Officials

5-5. Liability of Cardholders and Billing Officials

CHAPTER 6 - OPERATIONAL GUIDANCE AND PROCEDURES

6-3. National Defense Authorization Act Section 889 Representation

6-4. Third Party Payment Requirements

6-7. Purchase Request and Approval Sample Template

6-9. Payments of Monthly Invoices

6-10. Disputes, Defective Items and Fraudulent Transactions

6-15. Deployed to an OCONUS Area of Responsibility (AOR)

6-16. Official Representation Funds (ORF)

6-17. Cable, Utilities, and Telecommunications Services (CUTS)

6-18. Freedom of Information Act (FOIA) Requests

7-6. Commands not Utilizing GFEBS or DFAS for Refund Processing

CHAPTER 8 - EDUCATION, TRAINING AND TUITION ASSISTANCE

8-1. Training, Education and Professional Development (TE&PD) Services

8-2. Individual Slots in Existing COTS Course

8-3. Entire COTS Course (Group Training)

8-5. Subscriptions for Training Access

8-6. Training Purchase Examples

8-7. Use of the GPC for Tuition Assistance

8-8. Repayment of Training Expenses

CHAPTER 9 - REQUIRED SOURCES OF SUPPLIES AND SERVICES

9-2. UNICOR/Federal Prison Industries

9-4. Computer Hardware, Enterprise Software and Solutions (CHESS)

9-5. U.S. Navy’s Spiral 4 Contracts

9-8. Non-Mandatory Sources of Supply

CHAPTER 10 - CONVENIENCE CHECKS

10-2. Establishing a Convenience Check Account

10-3. Convenience Check Reporting (IRS Form 1099)

10-4. Annual Convenience Check Review

10-5. Convenience Check Resources

CHAPTER 11 - MANAGEMENT CONTROLS AND PROGRAM OVERSIGHT

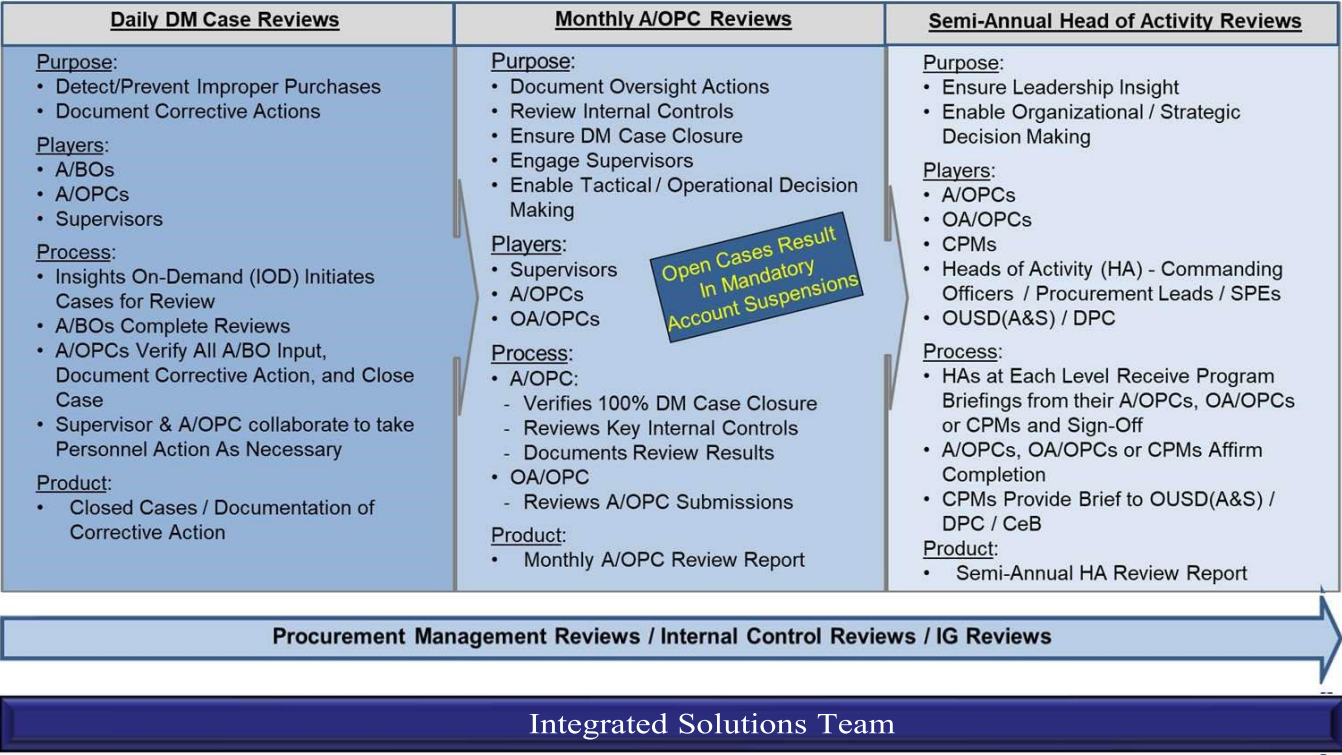

11-2. Three-Pronged Oversight Review Process

11-4. Data Mining Case Review and Closure

11-6. Semi-Annual A/OPC Reviews

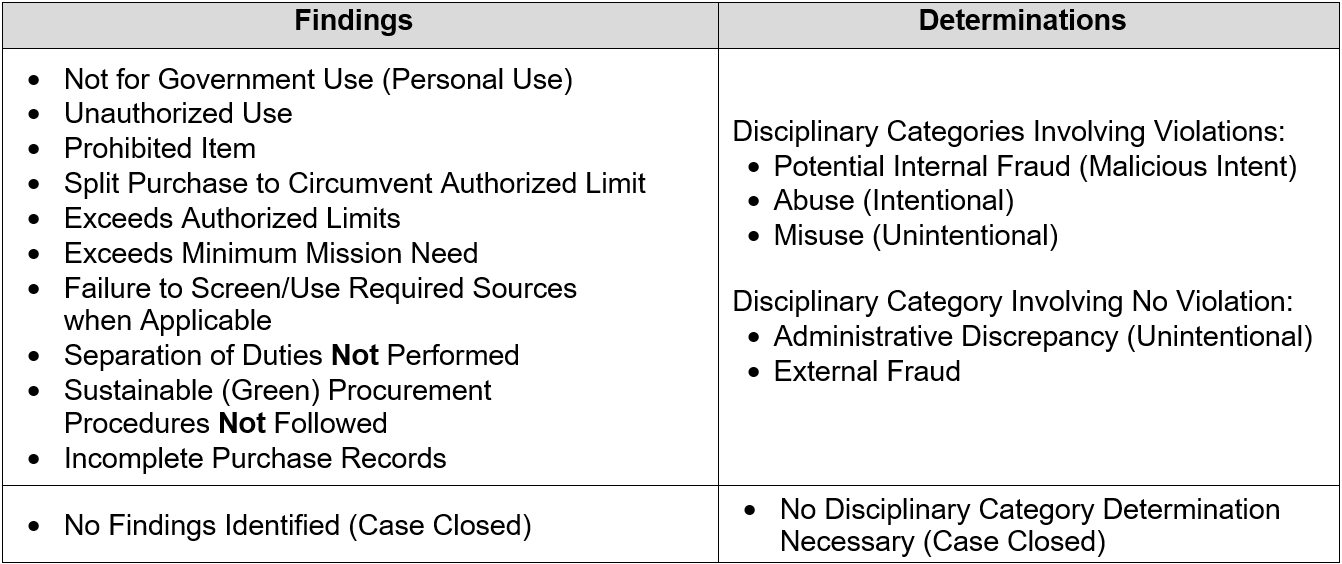

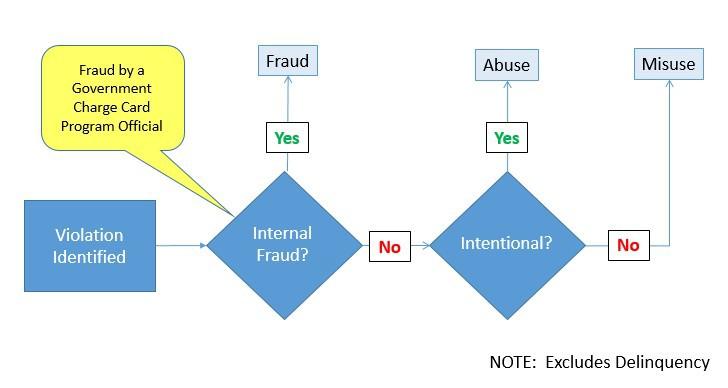

11-7. Disciplinary Requirements and Categories of GPC Violations

11-10. Cardholder Fraud and Merchant Fraud

11-11. Reporting and Monitoring for Fraud

CHAPTER 12 – EMERGENCY TYPE OPERATIONS

12-1. Emergency-Type Operations

12-2. Increased Thresholds and Acquisition Flexibilities for ETOs

12-3. Required Internal Controls for ETOs

12-4. Personnel Responsibilities for ETOs

CHAPTER 13 - MANAGEMENT REVIEWS

13-1. Level 4 A/OPC Annual Management Assessment

13-2. Level 3 Procurement Management Review

CHAPTER 14 - PROHIBITED AND RESTRICTED PURCHASES

14-2. Unauthorized Commitments and Ratification

14-6. Merchant Authorization Controls (MAC)

14-7. Detainees and Obligations under the Geneva Convention

CHAPTER 15 – CONTRACT PAYMENTS

15-3. GFEBS Purchase Order Creation

15-4. Payment Card Process Flow

15-5. Payment Plus Process Flow

15-7. Purchase Card Receiving Report (PCRR) Process

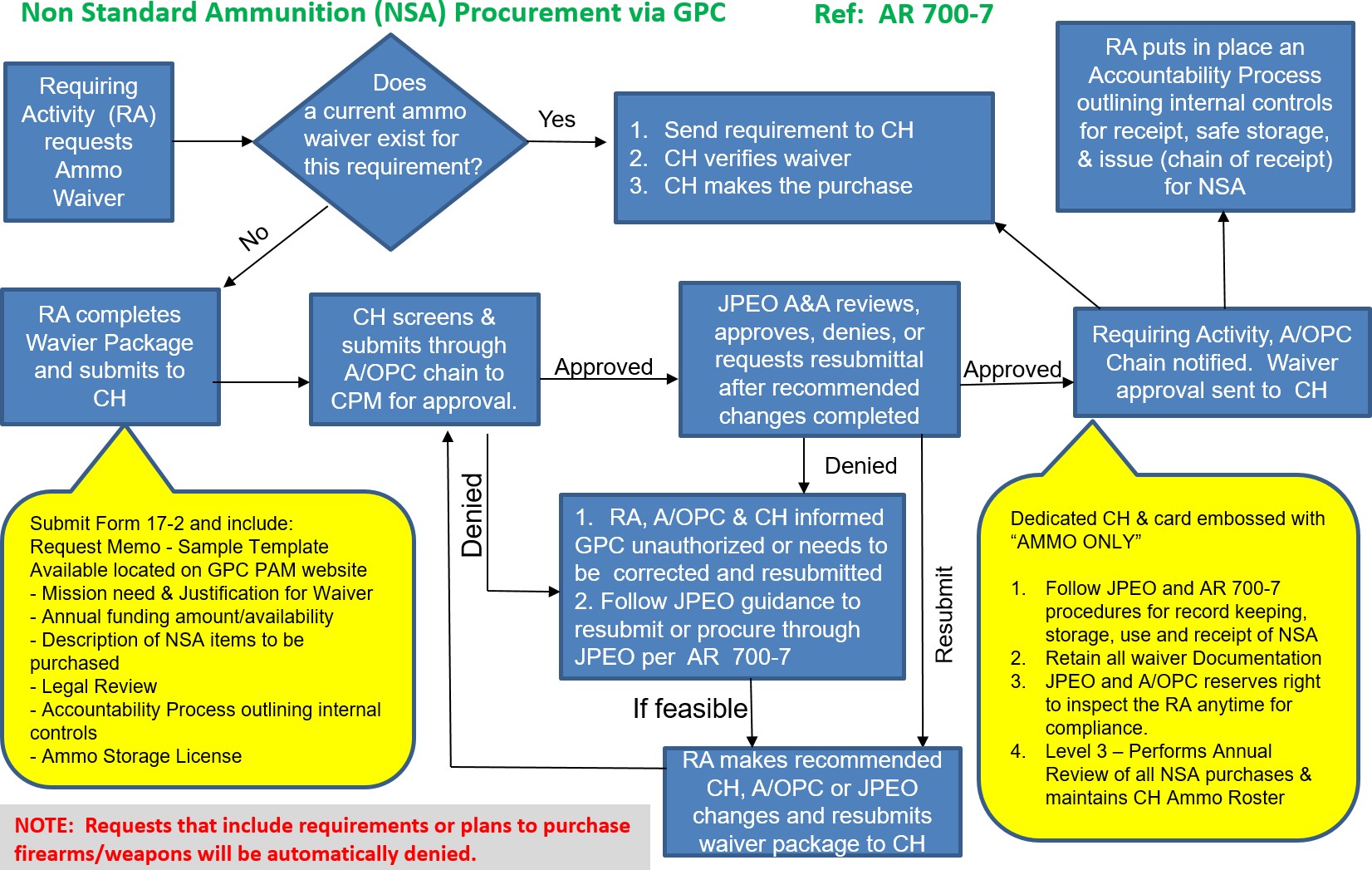

CHAPTER 16 - AMMUNITION AND WEAPONS

16-2. Authority to use the GPC for Non-Standard Ammunition (NSA) not from Army inventory

16-4. Funding Non-Standard Ammunition (NSA)

16-5. Explosives, Toxins, and Ammunition Definitions

CHAPTER 17 – METRICS AND REPORTING

17-2. Reports for Monitoring and Oversight

17-3. Standard Reports in the Servicing Bank’s EAS

17-4. Custom Reports within the Servicing Bank

CHAPTER 1 - THE GOVERNMENT PURCHASE CARD PROGRAM

1-1. Overview

a. The Army Federal Acquisition Regulation Supplement (AFARS) Appendix EE provides policy guidance and procedures for the management of the Army Government Purchase Card (GPC) program. It implements and supplements sections of the Department of Defense (DoD) Government Charge Card Guidebook for Establishing and Managing Purchase, Travel, and Fuel Card Programs (hereinafter referred to as the DoD Charge Card Guidebook). In the event of a conflict between DoD policy and Army policy, DoD policy takes precedence. In the event of a conflict between Army policy and command policy, Army policy takes precedence over any less-restrictive command policy. These operating procedures neither supersede nor take precedence over more-restrictive Army command procedures. This document applies to all purchases utilizing Army-issued GPCs.

b. Refer recommended changes and questions about the AFARS Appendix EE to the Office of the Deputy Assistant Secretary of the Army (Procurement) (ODASA(P)). Submit requests for waivers through the chain of command. Compliance with the AFARS Appendix EE is mandatory.

c. The GPC program provides Army and supported organizations a simplified, streamlined method of purchasing and paying for supplies, services, construction projects, and contract payments. The program complies with Federal, DoD, and Army statutory and regulatory guidance, as well as the terms and conditions specified in the most current General Services Administration (GSA) SmartPay® 3 Master Contract. The primary benefit of the GPC Program is that the card-issuing banks provide a commercial purchase and payment service that replaces the paper-based, time-consuming purchase order process; reduces procurement lead time; provides transaction cost savings; reduces procurement office workload; provides refunds; and facilitates payment to include reductions in interest payments.

d. The AFARS Appendix EE provides the procedures to use within the Army, including Army National Guard (ARNG) and Air National Guard (ANG), to establish and manage the Army GPC program. Army activities may supplement (i.e., adopt more stringent internal control requirements than the requirements cited herein), but not change this policy. However, as these are risk-managed programs, activities should maintain a proper balance between the control environment and ease of use to ensure that the benefits of the card continue to accrue. These procedures establish Army-wide standards designed to provide all Army activities with a foundation upon which to build specific standard operating procedures governing their programs.

e. Nonappropriated Fund (NAF) activities implement policies and procedures governing the Army’s Morale, Welfare, and Recreation programs and regulations for Nonappropriated Fund Instrumentalities (NAFI). Chaplaincy activities implement policies and procedures governing Army Chaplain Corps activities. Army NAFIs/entities must operate within the parameters of these procedures to include Public Health Command (PHC) NAFIs, Department of Defense Education Activities (DoDEA) NAFIs, and Army National Guard NAFIs. NAF activities will comply with the Department of Defense Policies and Procedures Governing Non-Appropriated Funds SmartPay® 3 Government-wide Commercial Purchase Card Use – SP3 Transition Memorandum #11. Non-appropriated funds (NAF)-funded GPCs issued under SmartPay3 must be properly segregated for oversight. All NAF GPC Cardholder (CH) accounts must be established under separate managing accounts (MAs). Commingling of appropriated and non-appropriated funded cards under a single MA is strictly prohibited.

1-2. GPC Uses

The purchase card can be used in three ways, depending on the value of the transaction and the authority of the cardholder (CH). See Federal Acquisition Regulation (FAR) 13.301. Table 1-1 summarizes the three methods and provides descriptions and examples.

Table 1-1: GPC Methods and Uses

| GPC Method | Description | Examples |

| Procurement Mechanism | To acquire and pay for goods and services by means other than the use of an existing contract. | Micro-purchases. See paragraphs a. and b. below. |

| Ordering Mechanism | To order and pay for goods and services under an existing contract only if authorized in the contract. | Orders placed against existing contracts. See paragraph c. below. |

| Payment Mechanism | To pay for goods and services when the Contractor agrees to accept contract payment(s) using the GPC card. | Contract invoice payments. Standard Form (SF) 182 training payments. See paragraphs d. and e. below. |

The GPC is the preferred method of payment for the following:

a. Micro-purchases (Card/Cardless). The GPC may be used to purchase fixed-price commercial supplies and services that do not require the CH to agree to any terms and conditions other than price and delivery. These purchases are limited to the applicable micro-purchase threshold (MPT).

b. Micro-purchases (Convenience Check). Convenience checks may be used and set up under a separate billing official (BO) account to buy commercially available, fixed-price supplies and services to fulfill mission-essential requirements. All check purchases must be within the applicable convenience check MPT. A separate account must be issued for each convenience check account.

c. Orders Against Pre-Existing Contract Vehicles. The GPC may be used to place task or delivery orders against pre-priced contract vehicles and agreements if authorized in the basic contract, basic ordering agreement, or blanket purchase agreement. (Appropriated fund CHs cannot purchase against nonappropriated fund contracts.)

d. Contract Payments. The GPC may be used to make payments against funded contracts found to be advantageous to the Government when compared to other methods of payment, and the contractor accepts payment by the GPC. The contract should include the third-party payment clause identified in FAR 32.1108, Payment by Governmentwide Commercial Purchase Card; however, GPC contract payments may be made if the contractor agrees to accept the GPC as a method of payment.

e. Payment of Training Requirements on SF 182s. The GPC may be used as the method of payment for commercial training requests using the SF 182, valued at or below $25,000, in lieu of an employee reimbursement by miscellaneous payment in accordance with the procedures to directly pay the provider in DoD Financial Management Regulation (FMR) Volume 10, Chapter 12, Section 120323, and DoD Instruction (DoDI) 1400.25, Volume 410.

1-3. Information and Waiver Process

a. Cardholders should direct GPC-related questions to their Agency/Organization Program Coordinator (A/OPC) (Level 4 A/OPC). If the A/OPC cannot resolve an issue, the A/OPC should direct the question to the Oversight Agency/Organization Program Coordinator (OA/OPC) (Level 3 A/OPC). If the OA/OPC cannot resolve the issue, the OA/OPC should consult the Component Program Manager (CPM) (Level 2 A/OPC) for guidance. GPC personnel should coordinate with their local legal counsel as necessary.

b. All waivers, exceptions, and deviations to the policies, procedures, and tools provided in AFARS Appendix EE must be submitted, in writing, through the major command acquisition chain of command to the ODASA(P) for approval. The CPM will retain copies of all approved waiver packages. In times of emergencies, a waiver approval may be obtained either through email or telephone call from the CPM with a follow up waiver request letter from the requesting command/activity. The letter must detail the reasons for the request and what adverse mission impact would occur if the waiver was not granted.

1-4. Task Order and Period of Performance

The Office of the Under Secretary of Defense (OUSD) for Acquisition and Sustainment, Defense Pricing, Contracting, and Acquisition Policy (DPCAP), United States (U.S.) Army, U.S. Department of the Air Force, and Defense agencies and activities awarded a Tailored Task Order #47QRAC18F0003 to U.S. Bank under GSA SmartPay® 3 Master Contract GS-36F-GA001. The period of performance began 30 November 2018 and runs through 29 November 2031 if all contract options are exercised. The total duration of the contract period of performance, including the base period and exercise of all three options and extension, is not to exceed 13 years and six months.

1-5. GPC Authority

a. GPC programs require procurement authority to operate and cannot be established or maintained unless procurement authority is granted in accordance with governing laws and regulations and delegated through a contracting activity identified in Defense Federal Acquisition Regulation Supplement (DFARS) Procedures, Guidance, and Information (PGI) 202.101 and the DoD Charge Card Guidebook. Contracting authority flows from authorities granted in Titles 10 and 41, United States Code (10 and 41 USC) from DoD to the Secretary of the Army to the Heads of Contracting Activities (HCAs). The HCA re- delegates contracting authority to local procurement offices. The Senior Contracting Official (SCO) or Chief of Contracting Office (CCO) may re-delegate their GPC procurement authority listed in Table 1-3 to OA/OPCs or A/OPCs for OA/OPCs and A/OPCs to appoint cardholders and convenience check account holders through the Delegation of Contracting Authority Letter produced in the Joint Appointment Module (JAM) within the Procurement Integrated Enterprise Environment (PIEE). See sections 1-8 and 5-1 for more information. Cardholders must countersign to acknowledge this responsibility.

b. The Joint Appointment Module (JAM), an application within PIEE, is the mandatory enterprise tool for appointing and delegating authority to GPC personnel.

c. Orientation and training are prerequisites to receiving GPC delegated authority via an appointment in JAM. Training requirements are listed in Chapter 4.

d. Generally, only a government employee can be a cardholder or billing official. National Guard traditional members and State employees should not be CHs or BOs. The following exceptions apply:

1) Foreign nationals may be appointed as CHs only if they are direct-hires working for the U.S. Government. However, commanders/directors should consider the potential consequences of appointing foreign nationals as CHs in countries where Status of Forces Agreements (SOFAs) or local laws do not subject the foreign national employee to the same pecuniary or general financial liability or disciplinary actions for charge card violation as U.S. citizens.

2) Junior Reserve Officer Training Corps (JROTC) instructors are members of the Armed Forces in accordance with USACC Regulation 145-2, section 4-2, and may be designated micro- purchase procurement authority as GPC cardholders. See FAR 1.603-3(b).

1-6. Applicability

a. These procedures apply to all GPC purchases with cards and convenience checks issued by the Army. Non-Army tenant organizations issued Army GPCs or convenience checks by an Army contracting office are also subject to these procedures. All BOs, CHs, A/OPCs, Resource Managers (RMs), Logisticians, and other stakeholders participating in the Army GPC program are subject to these procedures, including any non-Army tenant organizations where the Army has contracting authority and oversight responsibilities (such as ANG units).

b. The ODASA(P) has overall responsibility for the Army GPC program. Each Army command, organization, or activity utilizing Army GPCs has the responsibility for the following actions:

1) Provide adequate resources and effective internal controls to ensure the appropriate management, operation, training, and oversight is in place to operate a local GPC program effectively and efficiently in compliance with Army policies and procedures.

2) Establish and maintain a command climate to prevent Army personnel or others from exercising undue influence over the actions of an A/OPC, BO or CH.

3) Take appropriate informal and formal disciplinary actions in the event of noncompliance, fraud, misuse and/or abuse. Disciplinary actions should be based on the severity and frequency of the infraction and can range from informal actions such as written or verbal counseling, to demotion, removal, loss of security clearance, or potential criminal prosecution.

1-7. Micro-purchase Thresholds (MPT)

The definition and current dollar values are located at FAR 2.101(b) and summarized in Table 1-2.

Table 1-2: DoD Micro-purchase Thresholds

| DoD Micro-purchase Thresholds | |||

| Function | Threshold | Authority | |

| 1 | Federal-Wide Open Market | $10,000 | FAR 2.101, FAR 13.2 |

| 2 | Construction subject to 40 USC Chapter 31, subchapter IV, Davis-Bacon Wage Rate Requirements | $2,000 | FAR 2.101, FAR 13.2 |

| 3 | Services subject to 41 USC Chapter 67, Service Contract Labor Standards | $2,500 | FAR 2.101, FAR 13.2 |

| 4 | GPC Emergency-Type Operations (ETO) Inside U.S. | $20,000 | FAR 2.101, DFARS 213.270(c)(3) DFARS PGI 213.201 |

| 5 | GPC ETO Outside U.S. | $35,000 | FAR 2.101, DFARS 213.270(c)(3) DFARS PGI 213.201 |

| 6 | Federal-Wide Higher Education Open Market | $10,000 or greater | Class Deviation 2018-O0018 |

| 7 | GPC Convenience Checks (General – Unrelated to ETO and Other Emergency Uses) | $5,000 | P.L. 115-91, National Defense Authorization Act for Fiscal Year 2018, Sec. 806(b) |

| 8 | GPC Convenience Checks for ETO and Other Emergency Uses (Inside U.S.) | $10,000 | P.L. 115-91, National Defense Authorization Act for Fiscal Year 2018, Sec. 806(b) |

| 9 | GPC Convenience Checks for ETO and Other Emergency Uses (Outside U.S.) | $17,500 | P.L. 115-91, National Defense Authorization Act for Fiscal Year 2018, Sec. 806(b) |

1-8. GPC Delegations of Authority and Appointment Letters

The different types of delegation of authority appointments identified in this section and Table 1-3 are available to CHs as needed. Each authority has unique policies, procedures, training, and oversight requirements. CHs must have the appropriate designation in their JAM appointment in order to use the corresponding purchasing authority. These appointments can only be granted to individuals who have completed training commensurate with their delegated authority.

Table 1-3: GPC Delegation of Authority and Limits

| # | Authority Type | Delegation Authority | Delegation Not to Exceed Limit | Scope of Authority Limits |

| 1 | Micro- Purchase CH | FAR 1.603-3(b) FAR 13.201 DFARS 201.603- 3(b) | $10,000 | Grants authority to make authorized GPC purchases valued below the MPT using simplified acquisition procedures. (See FAR 2.101 “micro-purchase” definition.) CHs who only have this designation do not have the authority to place orders against any contract, including GSA federal supply schedule (FSS) orders using GSA Advantage and orders against FedMall contracts. CHs who will place orders against any contract also require the Contract Ordering Official CH designation in their appointment. |

| 2 | Micro- Purchase Convenience Check Writer | FAR 1.603-3(b) FAR 13.201 DFARS 201.603- 3(b) | $5,000 | Grants authority to make authorized convenience check purchases valued below the MPT using simplified acquisition procedures. (See FAR 2.101 “micro-purchase” definition.) |

| 3 | Higher Education Micro- Purchase CH | FAR 1.603-3(b) FAR 13.201 DFARS 201.603- 3(b) Class Deviation 2018-O0018 | $10,000 but HCA determination can result in higher value (unlimited) | Grants authority to make authorized open market micro-purchases using the GPC up to any applicable “Higher Education” MPT. (See MPT definition at FAR 2.101 & Class Deviation 2018-O0018.) This authority is generally limited to $10,000, but FAR 2.101 MPT definition allows for higher threshold after appropriate HCA determination. Not for use to make payments against approved SF 182s. |

| # | Authority Type | Delegation Authority | Delegation Not to Exceed Limit | Scope of Authority Limits |

| 4 | Micro- Purchase ETO Cardholder and/or Check Writer | FAR 1.603-3(b) FAR 13.201 FAR 13.201(g) DFARS 201.603- 3(b) | ETO CH: $20,000 Inside U.S. $35,000 Outside U.S. ETO Checkwriter: $10,000 Inside U.S. $17,500 Outside U.S. | Grants authority to make authorized open market micro-purchases using the GPC up to the applicable “Contingency” MPT. (See MPT definition at FAR 2.101.) If intent to authorize CH to place orders against any contract, a Contract Ordering Official CH designation is also required. ETO Checkwriter limits are one half of ETO MPTs. |

| 5 | Warranted ETO Contracting CH | FAR 1.603-3(a) FAR 2.101 MPT FAR 2.101 SAT DFARS 201.603- 3(b) DFARS 213.301(3) | $1,500,000 Outside the U.S. | Grants Contracting Officers supporting Contingency Operations and Humanitarian and Peacekeeping Operations authority to make authorized GPC purchases outside the U.S. as authorized in DFARS 213.301(3) for use outside the U.S. using simplified acquisition procedures up to the applicable Simplified Acquisition Threshold (SAT). (See FAR 2.101 definition of SAT.) The GPC appointment letter may only be issued to individuals who have previously been issued an SF 1402 delegating them authority sufficient to serve as a Contingency Contracting Officer. |

| 6 | Contract Ordering Official CH CHs who will place orders against any contract, including GSA FSS orders on GSA Advantage and FedMall contracts at any dollar level, require this designation. | FAR 1.603-3(a) FAR 8.4 FAR 13.301(b) FAR 13.301(c)(2) AFARS 5113.202- 90(c) DPCAP JAM Role Descriptions Guide | Simplified Acquisition Threshold $250,000 for CHs that are trained contracting professionals in the contracting office (1102s) $25,000 for CHs outside a contracting office | Grants authority to place and pay for authorized GPC purchases against the following: 1) Orders from GSA federal supply schedule contracts. 2) Orders from FedMall contracts, Computer Hardware Enterprise Software and Solutions (CHESS) IDIQ contracts, Governmentwide acquisition, and multi- agency contracts. 3) Blanket purchase agreements. 4) Indefinite Delivery, Time-and-Material, or Labor-Hour contracts that have firm fixed prices and pre-arranged terms and conditions that were awarded by a warranted contracting officer (KO) who designated the CH, to place orders. The KO is responsible for performing oversight and reporting any concerns to the A/OPC. Contract Ordering Official training must be completed before using this authority. A/OPCs must ensure additional controls and oversight procedures are in place before granting this authority. |

| # | Authority Type | Delegation Authority | Delegation Not to Exceed Limit | Scope of Authority Limits |

| 7 | Overseas Simplified Acquisition CH | FAR 1.603-3(a) for > MPT FAR 1.603-3(b) for < MPT DFARS 213.301(2) | $25,000 | Grants authority to make authorized GPC purchases valued up to $25,000 using simplified acquisition procedures when the CH is outside the U.S. for items/services to be used outside the U.S., and that comply with the requirements of DFARS 213.301(2). |

| 8 | Contract Payment Official CH | FAR 13.301(c)(3) | As specified in the delegation of authority letter and contract. Not to exceed the KO’s warrant authority. | Grants authority to make contract payments when authorized by the contract terms and conditions. |

| 9 | Miscellaneous Payments Official CH (SF-182 Training Payments) | DoD Charge Card Guidebook DoD FMR Vol 10, Ch. 12, Sec 120323 DoDI 1400.25 Volume 410 | $25,000 | Grants authority to make payments for commercial training requests using the SF 182, valued at or below $25,000, in lieu of an employee reimbursement by miscellaneous payment in accordance with the procedures to directly pay the provider in DoD FMR Volume 10, Chapter 12, Section 120323, and DoDI 1400.25, Volume 410. |

| 10 | Inter/Intra- Govern- mental Payment Official CH | TFM Vol. I, Part 5, Ch 7000 DPCAP memo, “Guidance on the Implementation of Adjusted Government Charge Card CH Special Designation Thresholds,” dated Oct 6, 2020 | $10,000 | Grants authority to make inter/intra-governmental transactions (IGT) or payments to another Government entity in lieu of using a Military Interdepartmental Purchase Request (MIPR). Includes payments to: DLA Document Services Department of Agriculture offered training FedMall GPC Requisitioning GSA Global Supply requisitioning |

a. Micro-Purchase Cardholder. This authority allows CHs to use the GPC to buy commercially available, fixed-price supplies and services to fulfill mission-essential requirements. The maximum single transaction dollar limit for stand-alone purchases is the MPT as defined at FAR 2.101.

b. Micro-Purchase Convenience Check Writer. This authority allows CHs to use a GPC convenience check to buy commercially available, fixed-price supplies and services to fulfill mission- essential requirements. Since convenience checks expose the Government to greater risk, CHs must make every effort to use a GPC card before writing a check. CHs may only use this authority when use

of the GPC is not possible. All check purchases must be within the applicable convenience check MPT. DoD FMR Volume 10, Chapter 23 establishes the financial management policy for convenience check accounts.

c. Micro-Purchase Emergency-Type Operations (ETO) CH and/or Check Writer. This authority allows CHs to buy commercially available, fixed-price supplies and services to fulfill mission-essential requirements in direct support of a declared contingency or emergency event. The ETOs currently included in 41 USC 1903 are:

1) Contingency Operations as defined in FAR 2.101;

2) Operations to facilitate the defense against or recovery from cyber, nuclear, biological, chemical, or radiological attack against the United States as addressed in FAR 18.001;

3) Operations in support of a request from the Secretary of State or the Administrator of the United States Agency for International Development to facilitate the provision of international disaster assistance as addressed in FAR 18.001; and

4) Operations to support response to an emergency or major disaster as defined in Section 102 of the Robert T. Stafford Disaster Relief and Emergency Assistance Act (42 USC 5121

,

implemented in FAR 26.2).

The group term “ETO” also includes humanitarian or peacekeeping operations (as defined in FAR 2.101). Currently, when supporting humanitarian or peacekeeping operations in accordance with FAR 2.101, the MPT does not increase, regardless of whether the humanitarian or peacekeeping operation is taking place inside or outside the United States; and the SAT can increase to $500,000 upon determination by the HCA that the respective supplies or services directly support the humanitarian or peacekeeping operation. FAR 18.2 addresses Emergency Acquisition Flexibilities (EAFs). It is critical to verify whether increased EAFs have been authorized for the particular ETO being supported. If so, each HCA has the authority to authorize use of EAFs.

d. Warranted Overseas ETO Cardholder. This authority allows CHs to use the GPC in conjunction with their separately issued SF 1402 Certificate of Appointment to purchase supplies and services as prescribed in DFARS 213.301(3). Contracting officers may use this authority to make purchases up to the applicable simplified acquisition threshold in support of declared contingency or emergency events.

e. Contract Ordering Official. This authority allows CHs with the appropriate training to issue fixed- price orders against existing contracts (e.g., GSA FSS, BPAs, FedMall contracts, CHESS contracts) to fulfill mission-essential requirements for supplies and services valued up to the Contract Ordering Official single purchase limit and to use the GPC to pay for these orders/purchases. When using this authority, CHs must 1) ensure they are authorized to place orders by the contract terms and conditions, 2) ensure the order will comply with all the contracts terms and conditions, and 3) follow all applicable ordering procedures. When ordering above the MPT, CH should obtain pricing from small business when small business can meet the requirements. The CH should obtain quotes from at least three sources. If restricting competition to fewer than three sources, the CH should document the circumstances in the purchase file. CHs with this designation will be referred to as “Ordering Officials” throughout this document. The Army Ordering Officer Guide standardizes procedures for selecting, appointing, and terminating ordering officers in accordance with AFARS 5101.602-2-92 and provides guidance for appointed individuals. This guide is to be utilized in conjunction with AFARS Appendix EE.

f. Overseas Simplified Acquisition. This authority allows CHs to make authorized GPC purchases up to a single purchase limit of $25,000 when the CH is outside the U.S. for items/services to be used outside the U.S., and that comply with the requirements of DFARS 213.301(2). When ordering above the MPT, the CH should obtain quotes from at least three sources. If restricting consideration to fewer than three, document the circumstances in the purchase file.

g. Contract Payment Official. This authority allows CHs to use the GPC to make payments against contracts that have been signed by a Contracting Officer when the GPC is named as the payment method. The GPC may provide a streamlined way of paying for contracts when a contracting officer determines the use of the GPC is in the best interest of the Government (AFARS 5113.202-90(d)).

h. Miscellaneous Payments Official (SF 182 Training Payments). This authority allows CHs to make payments for commercial training requests using the SF 182, valued at or below $25,000 in accordance with the procedures to directly pay the provider in DoD FMR Volume 10, Chapter 12, Section 120323, and DoDI 1400.25, Volume 410a. The SF 182 or equivalent must be completed prior to the training. When provided by a non-Government source, the training must consist of a regularly scheduled, commercial-off-the-shelf (COTS) course, training conference, or instructional service that is available to the public and priced the same for everyone in the same category, e.g., price per student, course, program, service, or training space.

i. Inter/Intra-Governmental Payment Official. This authority allows CHs to make payments to another Federal Government entity in lieu of using a MIPR or Inter-Governmental Payment and Collection (IPAC) in accordance with the DoD FMR. This authority includes, but is not limited to, payments to DLA Document Services, U.S. Department of Agriculture (USDA)-offered training, GSA Global Supply, Commissary, and FedMall GPC requisitioning. (Purchases from State and Local governments are considered traditional open-market micro-purchases and therefore are covered by the applicable authority listed above.) Special requirements for this authority include the following:

1) The not-to-exceed value is dictated by TFM Volume 1, Part 5, Chapter 7000, Section 7055.20.

2) Federal Government entities must limit their credit card collections so that individual transactions are no more than $10,000, which is the daily GPC credit limit for third-party purchases. The Treasury encourages use of IPAC for payments between Federal Agencies, debit cards, Automated Clearing House (ACH) debits/credits, and Fedwire transactions.

3) Card acceptance policies can be found in TFM Volume I, Part 5, Chapter 7000, which addresses limitations on credit card transactions.

4) IGTs exceeding $10,000 must be made with an alternative payment method (e.g., IPAC for payments between Federal Agencies, debit cards, ACH debits/credits, and Fedwire transactions).

CHAPTER 2 - PROGRAM ORGANIZATION, ROLES, AND RESPONSIBILITIES

The general roles and responsibilities of the participants in the purchase card program are presented in the following regulations:

a. DoD Charge Card Guidebook

b. AFARS Appendix EE and AFARS 5113.201

c. Chapter 4500 of the Treasury Financial Manual

d. Office of Management and Budget (OMB) Circular 123, Appendix B Revised, Chapters 4

e. DoD FMR Vol. 5, Ch. 33 and Vol. 10, Ch. 23

2-1. Responsibilities and Governmental Functions

All GPC Program personnel will complete GPC-specific training prior to being appointed any GPC responsibilities. GPC personnel will keep their GPC training current to continue to hold GPC positions. Program personnel must protect the information derived from use of the GPC. All appointments must be made in JAM, an application within PIEE used by GPC participants to initiate, review, approve, maintain, and terminate GPC appointment and delegation letters. Paper copies of appointments are not required if appointments are issued using JAM. Government contractor employees will not be appointed as A/OPCs, BOs, or CHs, nor perform independent receipt of goods and services and will not be granted access to the card-issuing bank’s electronic access system (EAS) or any of the business IT systems, but may be granted read-only access to the card-issuing bank’s EAS upon Level 3 A/OPC approval.

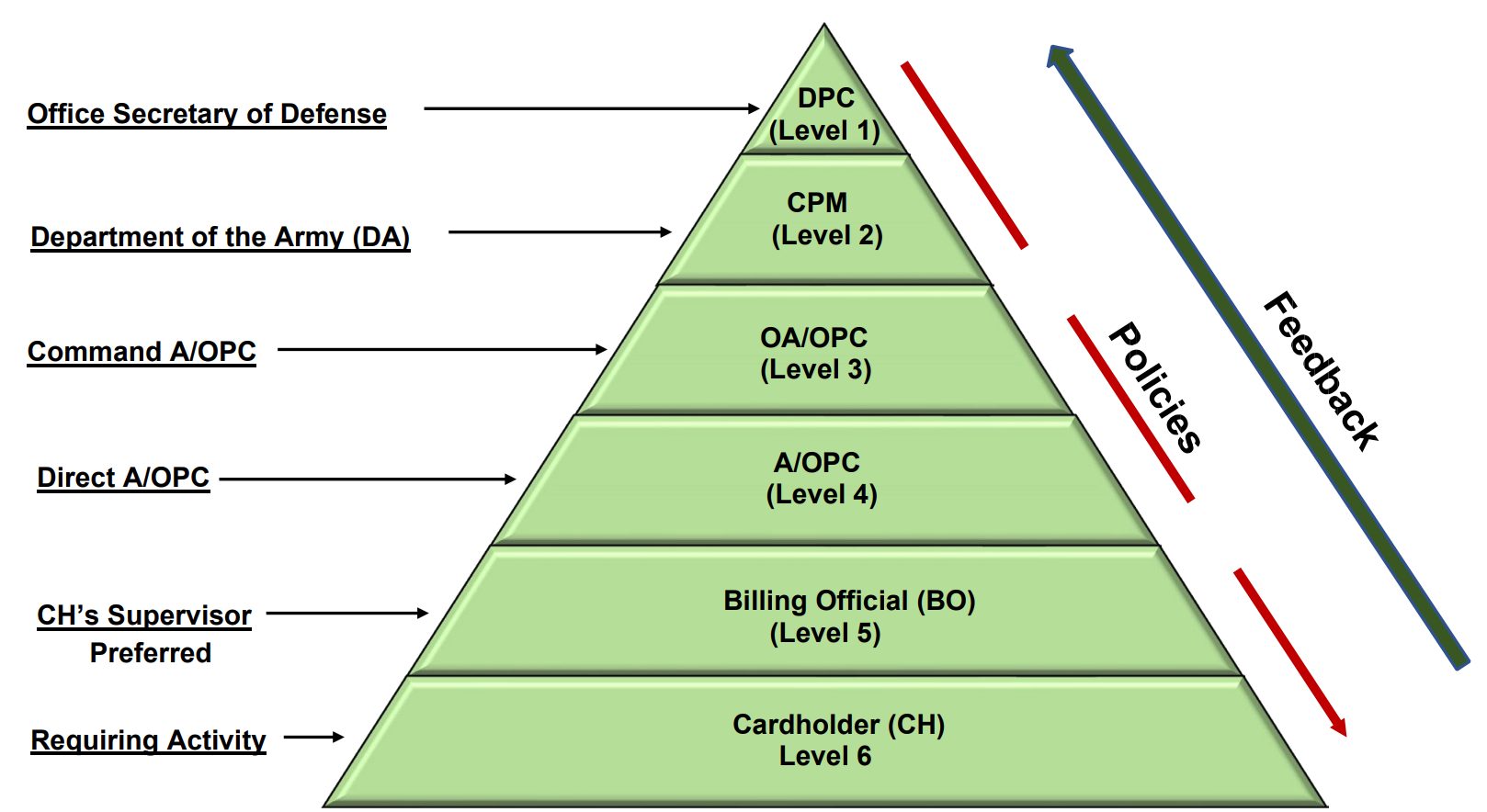

2-2. Program Hierarchy Structure and Roles and Responsibilities

The GPC Program is founded on a six-tiered hierarchal reporting chain of command system identified in Figures 2-1 and 2-2. The formal names associated with specific roles within this hierarchy are often used interchangeably with the corresponding level of authority within the hierarchy. For instance, A/OPCs may be referred to as Level 4s, and the Army GPC CPM is often referred to as the Level 2. Table 2-1 describes the GPC roles in PIEE and JAM.

Figure 2-1: Hierarchy Chart

Figure 2-2: Hierarchy Structure

| Army Level/Hierarchy GPC Program Structure | ||

| Level 1 A/OPC | DoD | DPCAP manages the DoD GPC Program |

| Level 2 A/OPC (CPM) | ASA(ALT) DASA(P) | The DASA(P) appoints the CPM (Level 2 A/OPC) to administer the Army GPC Program. |

| Level 3 OA/OPC | Army Command (ACOM) or equivalent | ACOM or equivalent organization must possess HCA authority. SCO appoints the Level 3 A/OPC. SCO may delegate this appointment further. The SCO’s management responsibility for the GPC program may be delegated to the CCO. Level 3 A/OPC reports to the Level 2 A/OPC as required. |

| Level 4 A/OPC | Installation or equivalent | SCO or equivalent appoints the Level 4 A/OPC. SCO may delegate this authority to the CCO or equivalent. Level 4 A/OPC reports to the Level 3 A/OPC as required. |

| Level 5 | Billing Official and Alternate | CCO appoints the BO. This authority may be delegated to the Level 4 A/OPC. BO is also a certifying officer. BO monitors and approves CH purchases and certifies billing statements. |

| Level 6 | Cardholder | CH is the individual issued the GPC or convenience checks. Level 4 A/OPC appoints the CH (when CCO delegates the authority to A/OPC). CH must acknowledge authority and duties by signing appointment letter in JAM. |

Table 2-1: JAM GPC Roles

| # | GPC JAM and PIEE Roles | Who Submits Request | Additional Guidance Information | JAM Appointment Issued | How Is the Process Initiated? |

| 1 | GPC DoD Program Management Office (PMO) | DPCAP (Contracting eBusiness) The PIEE Hierarchy Level 1. | None | None | PMO representative registers for PIEE access and requests role. |

| 2 | Component Program Manager (CPM) | The PIEE Hierarchy Level 2. | None | CPM appointment letter | CPM registers for PIEE access and requests role. |

| 3 | GPC Delegating/ Appointing Authority (DAA) | Individual(s) (other than the A/OPC or OA/OPC with delegating authority) who have retained or been delegated authority to electronically sign GPC Delegation of Procurement Authority and GPC Appointment Letters (e.g., the Director of Contracts or SCO). | Servicing Agency A/OPCs should direct any individual at a “Requesting Agency” who has been delegated authority to sign delegation and appointment letters to request this role during PIEE registration. These individuals must have been issued an SF 1402 authorizing them to | None | DAA may register for PIEE access and request role or complete actions using only tokenized emails. |

| # | GPC JAM and PIEE Roles | Who Submits Request | Additional Guidance Information | JAM Appointment Issued | How Is the Process Initiated? |

| further delegate procurement authority. | |||||

| 4 | OA/OPC With Delegating Authority | Primary and Alternate A/OPCs with responsibility for managing / overseeing other A/OPCs. | None | OA/OPC Appointment Letter | OA/OPC registers for PIEE access and requests role. |

| 5 | OA/OPC Without Delegating Authority | Primary and Alternate A/OPCs with responsibility for managing / overseeing other A/OPCs. | None | OA/OPC Appointment Letter | OA/OPC registers for PIEE access and requests role. |

| 6 | A/OPC With Delegating Authority | Primary and alternate A/OPCs responsible for day-to-day management and oversight of CH and managing accounts. | None | A/OPC Appointment Letter | A/OPC registers for PIEE access and requests role. |

| 7 | A/OPC Without Delegating Authority | Primary and alternate A/OPCs responsible for day-to-day management and oversight of CH and managing accounts. | None | A/OPC Appointment Letter | A/OPC registers for PIEE access and requests role. |

| 8 | Approving/Billing Official (A/BO) | Program officials responsible for reviewing and approving GPC managing account (MA) billing statements (GPC bank invoices) and transaction supporting data for compliance with applicable acquisition policies. | None | A/BO Appointment Letter | OA/OPC or A/OPC nominates A/BO using JAM. A/BO responds to JAM- generated email direction to register for PIEE access. When A/BO uses the identical email entered during nomination, the role request and required DoDAACs are pre- populated. |

| 9 | Certifying Officer | Program officials responsible for reviewing GPC MA billing statements in accordance with DoD FMR requirements and certifying statements (GPC bank invoices) for payment. | Certifying Officer responsibilities are addressed in DoD FMR Volume 10, Chapter 23 (230406) and DAU CLG 006. Certifying Officer appointments are made in accordance with | DD Form 577 Certifying Officer Appointment | OA/OPC, A/OPC or DD 577 Appointing Authority (AA) nominates Certifying Officer using JAM. Certifying Officer responds to JAM- generated email direction to register for PIEE access. When Certifying Officer uses the identical email |

| # | GPC JAM and PIEE Roles | Who Submits Request | Additional Guidance Information | JAM Appointment Issued | How Is the Process Initiated? |

| DoD FMR Vol. 5, Chapter 5. | entered during nomination, the role request and required DoDAACs are pre- populated. | ||||

| 10 | Cardholder (CH) | Individuals who have been issued GPC CH accounts. | Includes carded, cardless, and convenience check accounts. 10 types of “Special Use” CH delegations are available. 2 of the 10 CH delegations are equivalent to issuance of a SF 1402 Certificate of Appointment. | GPC CH Appointment Letter | OA/OPC or A/OPC nominates CH using JAM. CH responds to JAM-generated email direction to register for PIEE access. When CH uses the identical email entered during nomination, the role request and required DoDAACs are pre-populated. |

| 11 | Component Resource Manager (CRM) | The Comptroller/FM for the Component. | None | None | CRM registers for PIEE access and re- quests role. (Note 5) |

| 12 | Oversight RM | Individuals responsible for approving RM access to PIEE; they can also perform all RM functions. | None | None | Oversight RM registers for PIEE access and requests role. |

| 13 | Resource Manager (RM) | Provides appropriate GPC account funding, enters associated lines of accounting (LOAs) into applicable systems, and works with the A/OPC to establish spending limits tied directly to funding allocated for each managing and CH account. | None | None | RM registers for PIEE access and requests role. |

| 14 | Supervisor | Supervisors of individuals with PIEE roles. | Supervisor information is available to JAM from the data the individual enters during their PIEE registration. Future PIEE releases are planned to connect to DEERS for | None | Not Required PIEE users identify their supervisor in their PIEE account profile. |

| # | GPC JAM and PIEE Roles | Who Submits Request | Additional Guidance Information | JAM Appointment Issued | How Is the Process Initiated? |

| supervisory information. | |||||

| 15 | DD577 View Only | Individuals in paying offices (e.g., DFAS) who need to view DD Form 577 appointments. Other individuals who require access to view DD Form 577s. May be granted to contractor personnel. | None | None | Registers for PIEE access and requests “DD 577 View Only User” role. |

| 16 | DD577 Appointing Authority | Individuals authorized by Component-level Financial Management procedures to sign DD Form 577 Certifying Officer appointments in accordance with FMR Vol 5, Ch 5. | None | None | Registers for PIEE access and requests “DD 577 Appointing Authority” role. |

| 17 | GPC Help Administrator (HAM) | Individuals providing help desk support to GPC program officials. | May be granted to contractor personnel. | None | Registers for PIEE access and requests “GPC Help Administrator” role. |

| 18 | GPC Auditor | Individuals granted access to PIEE GPC functionality for purposes of reviewing the GPC program | GPC Auditor is required to load a scanned copy of audit letter during PIEE registration process. Each request must specify the purpose, scope of the review, define the access required, and state the desired access period (start and end dates). Access requests must be approved by the CPM. | None | Self-Initiate. |

2-3. Component Program Manager (Level 2 A/OPC) Duties and Responsibilities

a. Administer the Army GPC Program.

b. Establish policies and guidelines.

c. Design and maintain hierarchies and approve subordinate Level 3 A/OPCs.

d. Interface with the DPCAP GPC program office on performance issues.

e. Ensure effective Army GPC surveillance (e.g., Procurement Management Reviews (PMRs)).

f. Liaison with Army organizations, the servicing bank, DPCAP, GSA, and other federal agencies.

g. Manage and implement technical and system enhancements.

h. Develop, test, and deploy GPC hardware/software/networking systems enhancements.

i. Review and submit monthly, semi-annual, and annual reports as required.

j. Implement trends, best practices, increase rebates, and lower costs to improve the program.

k. Participate in meetings, events, training events, and panel discussions representing the Army.

l. Communicate DoD and Army GPC policy/procedure updates and surveillance/audit findings.

m. Address systemic program deficiencies and discrepancies.

2-4. Primary and Alternate Level 3 A/OPC Duties and Responsibilities

a. Implement, administer, and monitor the ACOM GPC program subject to DoD and Army policies.

b. Serve as a liaison with all GPC Program stakeholders (e.g., HQDA, DPCAP, GSA, AAA, Bank).

c. Review and submit monthly and semi-annual IOD reports.

d. Inform Level 2 A/OPC of GPC program trends and issues as they arise.

e. Provide program support to ACOM and installation Level 4 A/OPCs.

f. Establish and implement ACOM-specific policy and guidelines.

g. Develop/implement program internal control requirements and surveillance plan.

h. Participate in GPC program meetings and events.

i. Suspend accounts and administer corrective actions for non-compliance.

j. Ensure all Level 4 A/OPCs meet education, training, and certification requirements.

k. Track training for Level 4 A/OPCs in PIEE/JAM.

l. Ensure all Level 4 A/OPCs hold appointment letters in PIEE/JAM.

m. Lead implementation of GPC systems at the Command level.

n. Coordinate GPC program changes with CPM (e.g., hierarchy changes, Level 3 appointments).

o. Respond to data calls in a timely manner and with concise, current data.

p. Oversee Level 4 A/OPC program controls, including managing account reviews and IOD reviews.

q. Manage agent numbers and periodically assess the ongoing need for agent numbers.

r. Manage enterprise data mining processes per DPCAP policy and procedures.

s. Maintain managing accounts to meet mission needs.

t. Communicate policy updates, procedure changes, and other information to Level 4 A/OPCs.

u. Process and retain waivers, exceptions and deviations.

v. Review and submit weekly, monthly, quarterly and annual reports as required.

w. Seek out trends and best practices to improve the Program.

x. Implement innovative means to increase rebates, lower administrative costs and merchant prices.

y. Proactively address and resolve emails at the lowest level.

z. Resolve deficiencies and discrepancies impacting program effectiveness and efficiencies.

aa. Perform PMRs every three years.

2-5. Primary and Alternate Level 4 A/OPC Duties and Responsibilities

a. Manage the day-to-day operation of the GPC program at an installation/organization.

b. Assist CHs and BOs in fulfilling their responsibilities.

c. Serve as the liaison between the Level 3 A/OPC and the installation/organization GPC personnel.

d. Liaison between the financial/contracting communities as it applies to the GPC payment process.

e. Serve as the installation/organization point of contact for bank-related matters.

f. Provide business advice to supporting organizations, CHs, BOs, and small business specialists.

g. Participate in meetings. Communicate Army policy updates and internal review findings.

h. Assist the Level 3 to increase rebates and lower administrative and merchant costs.

i. Ensure the proper disposition of rebate checks.

j. Ensure GPC Program personnel are properly trained and appointed.

k. Maintain currency in training to perform their respective duties.

l. Establish and maintain a manual or electronic file for each BO and CH per retention rules.

m. Establish, maintain, and terminate CH and BO accounts within the servicing bank’s EAS.

n. Ensure that all managing accounts have a primary and alternate BO.

o. Evaluate the effectiveness of each BO’s ability to review, approve and reconcile transactions.

p. Ensure timely reconciliation of all CH and BO accounts at the end of the billing cycle.

q. Coordinate with RMs to ensure timely certification and payment.

r. Confirm completion of required initial and refresher training for all CHs and BOs.

s. Maintain training records within PIEE and JAM.

t. Coordinate with the Accountable Property Officer (APO).

u. Provide training to CHs on property accountability procedures.

v. Nominate and appoint CHs and BOs within PIEE and JAM.

w. Maintain and terminate appointment letters in JAM.

x. Maintain program oversight through IOD, annual management assessment, and bank reports.

y. Complete all assigned IOD cases, monthly reviews, and semi-annual reviews per policy timelines.

z. Address program deficiencies and discrepancies identified in IOD.

aa. Annually assess each CH’s continuing need to maintain an account.

bb. Close unused accounts as appropriate.

cc. Request justification in writing from BOs when accounts with little activity must remain open.

dd. Perform Level 4 Annual Assessment using the Annual Assessment Checklist.

ee. Develop and implement local GPC procedures.

ff. Inform CHs of prohibited items and services.

gg. Monitor bank transaction reports to identify potential improper use of the GPC.

hh. Take corrective action to address any suspected legal or policy violations.

ii. In the event of unauthorized card activity or fraud, set the single purchase limit to $1.

jj. Monitor bank transaction declination reports to identify potential fraud activity.

kk. Review transactions of newly appointed CHs within four months of appointment.

ll. Reduce managing accounts as appropriate to meet mission needs.

mm. Process requests for user identifications in the servicing bank’s EAS.

nn. Screen any accounts which have not been used within six months and take appropriate action.

oo. Utilize the Semi-Annual Report to brief management.

pp. Process and retain waivers, exceptions, and deviations.

qq. Ensure lost/stolen cards are immediately reported.

rr. Temporarily suspend any account over 30 calendar days past due.

ss. Suspend entire Level 4 organization accounts for any account over 120 days past due.

tt. Review and submit reports as required.

uu. Analyze trends to improve the Program.

vv. Assist BOs and CHs with reports as necessary.

ww. Activate, deactivate/terminate, and maintain (adjust limits, etc.) CH and BO accounts.

xx. Identify, monitor, and resolve any terminated accounts with outstanding credits.

yy. Ensure appropriate separation of duties and span of control ratios are maintained.

zz. Proactively address automated email notifications (e.g., IOD cases or delinquencies). aaa. Address deficiencies and discrepancies impacting program effectiveness or efficiencies.

2-6. Primary and Alternate Level 5 - Billing Official Duties and Responsibilities

a. Review and reconcile CH statements against receipts and documentation.

b. If a CH is absent, approve CH’s statement within the required timeframe.

c. Certify billing statements electronically within 5 business days of the end of the billing cycle.

d. Forward official invoice to DFAS for manually paid accounts within 15 days of receipt.

e. Verify payments to be legal, proper, necessary, and correct per Government rules and regulations.

f. Complete all assigned IOD data mining cases in a timely manner.

g. Ensure CHs upload all transaction documentation in the servicing bank’s EAS.

h. Report questionable transactions to the Level 4 A/OPC and/or appropriate authorities for review.

i. Resolve any questionable purchases with the CH and A/OPC.

j. Recommend in writing GPC credit limits to the RM and Level 4 A/OPC, for CHs under BO account.

k. Coordinate with the bank to resolve payment issues.

l. Identify and communicate billing discrepancies to the bank’s transaction dispute point of contact.

m. Send a report to the A/OPC detailing the circumstances of any lost, stolen or compromised cards.

n. Ensure designation of the proper line of accounting.

o. Ensure an Alternate BO is appointed.

p. Notify the Level 4 A/OPC promptly to close any CH accounts no longer needed.

q. Notify the Level 4 A/OPC to terminate or reassign the BO account prior to departure/reassignment.

r. Serve as the point of contact for GPC compliance inspections/audits/reviews.

s. Support A/OPC surveillance reviews.

t. Complete any corrective actions identified after each audit or A/OPC review.

u. Establish/recommend CH and BO credit limits to the A/OPC based on historical use.

v. Ensure spending limits are held to the minimum amount necessary to meet mission requirements.

w. Ensure spending limits are not exceeded.

x. Verify appropriate and sufficient funds are available prior to CH purchases.

y. Ensure all transactions are for valid, official Government requirements.

z. Provide written approval or disapproval of purchase requests to the CH.

aa. Ensure sources are rotated when possible.

bb. Ensure CHs are not splitting requirements to avoid exceeding the MPT.

cc. Review and ensure supporting documentation is loaded in the bank’s EAS prior to certification.

dd. Register for electronic data notifications within the bank’s EAS for automated email alerts.

ee. Ensure convenience check data is maintained.

ff. Ensure Internal Revenue Service (IRS) Form 1099 has been completed and reported for convenience checks.

gg. Ensure sales taxes are not paid (as appropriate).

hh. Immediately notify A/OPC upon discovery of suspected unauthorized purchases.

ii. Notify the A/OPC when CH or BO personnel changes occur.

jj. Immediately notify of lost or stolen cards.

2-7. Level 6 - Cardholder Duties and Responsibilities

a. CH authority is limited to the threshold indicated on their delegation of authority in JAM.

b. Use GPC to make authorized purchases within the limits of their delegation of authority in JAM.

c. Screen all purchase requests upon receipt.

d. Verify that the requested items meet a legitimate government need.

e. Notify the BO of unusual or questionable purchase requests.

f. Check requirements for their availability from the mandatory Government sources.

g. Make purchases in accordance with FAR Part 8 required sources of supplies and services.

h. Rotate merchants when practicable.

i. Allocate transactions to the proper line of accounting.

j. Obtain BO approval prior to purchase. Obtain all required pre-purchase approvals.

k. Track receipt/acceptance of purchased goods or services.

l. Track partial shipments to ensure they are received within the dispute window.

m. Track any transactions for items not yet received.

n. Collect, maintain and upload the required purchase documentation in the servicing bank’s EAS.

o. Match orders and review and reconcile monthly statement.

p. Register to receive the bank’s Electronic Data Notifications (automated email alerts).

q. Resolve unauthorized, erroneous, or questionable transactions with merchants.

r. Dispute questionable transactions.

s. Dispute items not received in one billing cycle when reconciling the next billing cycle.

t. Dispute unresolved billing errors (e.g., supplies not received by the next billing statement).

u. Dispute transactions when receipt and acceptance of goods or services cannot be verified.

v. Dispute items the merchant fails to replace, modify, or repair by the allotted time.

w. Resolve any invalid transactions with the merchant.

x. Track all disputes to completion.

y. Confirm with the merchant the items ordered are in transit and track the transactions to completion.

z. Maintain physical security of the GPC and convenience checks to avoid unauthorized use.

aa. Do not release the account number to entities other than a merchant processing a transaction.

bb. Do not authorize merchants to store the card number.

cc. Notify the bank of a lost, stolen, or compromised GPC within one business day.

dd. Maintain the bank’s EAS purchase log, which is located under Transaction Management.

ee. Reconcile all transactions and upload all supporting documentation in the bank’s EAS.

ff. Approve the account statement within 3 business days of the cycle end date.

gg. Maintain a manual purchase log if the electronic purchase log in the bank’s EAS is not accessible.

hh. Ensure the Accountable Property Officer (APO) has screened the purchase request.

ii. Upload all receipts for the APO to review electronically in the servicing bank’s EAS.

jj. After items arrive, provide receipts to the supporting APO within five business days.

kk. Notify the BO when you are not available to approve the CH statement.

ll. Provide all records and purchase file documentation to the BO upon departure or reassignment.

mm. Maintain a separation of duties of making purchases and receiving the goods/services.

nn. Forward requirements exceeding the MPT to the contracting office for purchase.

oo. Verify and document receipt/acceptance of goods or services.

pp. Checkwriters - Maintain convenience check data.

qq. Checkwriters - Report IRS Form 1099 data to DFAS.

2-8. GPC Support Function Duties

a. Resource Manager GPC Support Function Duties.

1) Fund GPC purchases and provide a system of positive funds control.

2) Assist the Level 4 A/OPC in establishing and maintaining BO and CH accounts.

3) Assign default and alternate lines of accounting as appropriate.

4) Ensure obligations are posted prior to invoicing for non-Electronic Data Interchange (EDI) accounts.

5) Assist with resolving accounts that are in a delinquent status and provide payment information when requested.

6) Assist the Level 4 A/OPC with the surveillance of assigned accounts.

7) Monitor General Fund Enterprise Business System (GFEBS) and Defense Enterprise Accounting Management System (DEAMS) daily to identify account payment issues, prevent and resolve GPC payment delinquencies, correct Intermediate Document (IDOC) errors, and provide payment information upon request.

8) Provide guidance and training to installation RMs, BOs, and CHs on GFEBS/DEAMS processes.

9) Provide appropriate funding for the accounts and enter associated lines of accounting into applicable systems.

10) Establish spending limits that are tied directly to funding allocated for each billing and CH account.

b. Organizational PIEE Government Administrator Manager (GAM) GPC Function Duties.

1) Administer Location Codes.

2) Look up group names and GAM information.

3) View and edit user profile information.

4) Activate (add) and deactivate users.

5) Reset user passwords.

6) Reset certificates.

c. Defense Finance and Accounting Service (DFAS) Support Function Duties.

1) Provide tax reporting guidance to checkwriters. See Chapter 10-3.

2) Confirm the DD Form 577 for certifying officials.

3) Process EDI transaction sets 821, Obligation Files; and 810, invoice files, and notify the responsible installation or activity when the corresponding files are not received.

4) Notify the installation/activity, within one day, of rejects and interest penalties assessed to individual accounts.

5) Process requests for manual payments, e.g., bank system rejects and non-EDI accounts.

6) Assist in resolving GPC payment issues.

d. Senior Contracting Official (SCO), or equivalent Duties.

1) The SCO or equivalent is responsible for the operation and execution of their GPC Program in compliance with this document and the policies and procedures issued from the ODASA(P).

2) Develop internal management controls to operate, manage, provide oversight, and maintain the integrity of the local GPC Program.

3) Ensure adequate checks and balances are in place to manage local GPC programs.

4) Ensure CHs are not subjected to undue influence in performing their duties and responsibilities.

5) Ensure separation of duties. Individuals designated as A/OPCs will not be simultaneously designated as BOs or CHs. Individuals designated as BOs will not be a CH on the same managing account.

6) Manage span of control appropriately. Primary and alternate A/OPCs will not be responsible for more than 250 GPC accounts. An additional A/OPC must be appointed whenever the combined number of CH and managing accounts exceed the 250:1 ratio. The number of CH accounts assigned to a primary BO will not be more than seven (7:1). Additional BOs must be assigned by the organization whenever the number of CH accounts exceed the 7:1 ratio.

7) Ensure that A/OPCs have the necessary resources to accomplish program oversight.

8) Delegate appointing authority when needed. The HCA may retain the authority to appoint A/OPCs or delegate this authority to the SCO or equivalent. The SCO may further delegate this authority in writing as necessary and ensure all appointments are executed through JAM.

e. Accountable Property Officer (APO) GPC Support Function Duties.

1) Assist the A/OPC in reviewing card accounts to ensure that property accountability procedures are being followed.

2) Ensure property control and accountability procedures are developed and disseminated to all personnel who are entrusted with the acquisition of Army property and equipment.

3) Comply with accountability procedures in Army Regulation (AR) 710-4 and AR 735-5.

4) Record in property systems any sensitive and pilferable property purchased.

5) Determine the accounting requirements for the GPC purchased property, such as nonexpendable or controlled (requires property to be accounted for on property book records), durable (requires control when issued to the user) and expendable (no requirement to account for on property book records).

6) Pre-approve all Army purchase request forms (or similar local forms) for applicable items.

7) Require CH to provide copy of receipt/invoice along with proof of independent receipt/acceptance within 5 days of receipt of accountable item.

8) Determine if an exception applies for the purchase of training, services, or consumable supplies (e.g., office supplies, batteries).

f. Audit Agencies.

1) Auditors are authorized data access to retrieve GPC data within the GPC EAS systems. Specific roles are established in all GPC EAS systems when granted access for a limited amount of time.

2) GPC Auditor should load a scanned copy of the audit letter during the PIEE registration process. Each request must specify the purpose, scope of the review, define the access required, and state the desired access period (start and end dates). Access requests must be approved by the CPM.

3) Assist Army leaders in assessing and mitigating GPC risk by providing solutions through independent internal auditing services.

4) Ensure the ODASA(P) has an opportunity to participate in a proactive audit planning process, which is responsive to GPC management and acquisition needs.

2-9. Management of the GPC Program

a. The ODASA(P) has overall responsibility for the management of the Army GPC program. The ODASA(P) appoints a CPM, also known as the Level 2 A/OPC, to manage the Army GPC program. The SCO, or in activities that do not have a SCO, the CCO or equivalent, designates, at a minimum, one Level 3 OA/OPC and an alternate Level 3 OA/OPC who, once appointed in JAM, is dedicated to the management of the GPC Program within their agency/organization. The SCO or CCO may further delegate in writing the authority to appoint the Level 3 and 4 A/OPCs in accordance with Army policy. Level 3 A/OPCs with authority to delegate procurement authority must have the corresponding appointment letter in JAM to appoint Level 4 A/OPCs. Level 4 A/OPCs may appoint CHs and billing officials in JAM if they are given the authority to delegate procurement authority and have the corresponding appointment letter in JAM. Certifying officers must be appointed by the organization’s designated DD 577 appointing authority in JAM.

b. The Level 3 OA/OPC duties and responsibilities at Army major command headquarters typically warrant a grade (or equivalent thereof) of GS-14, preferably in the contracting career field. Exceptions may apply. The Level 3 A/OPC duties and responsibilities for non-headquarter commands typically warrant a grade of GS-12 to GS-14, preferably in the contracting career field, but exceptions may apply if approved by the SCO or CCO.

c. The Level 4 A/OPC duties and responsibilities typically warrant a grade (or equivalent thereof) of GS-11 to GS-12 in any career field (e.g., 1101, 1105, or 343) if they meet the knowledge, skills, and abilities listed below. Exceptions may apply. The grade should reflect the corresponding complexity of their duties and responsibilities. The A/OPC will be designated by the appropriate contracting official to be responsible for the management, administration, and day-to-day operation of the GPC program at the activity. Written delegations are required in JAM, and each A/OPC will be granted the appropriate system access (e.g., JAM, bank EAS) associated with their role.

d. Level 3 and 4 A/OPCs must complete the training requirements detailed in Chapter 4. Only individuals who possess the following knowledge, skills, and abilities may be appointed as Level 3 and 4 A/OPCs for the GPC Program:

1) Understanding of the relevant GPC policies, procedures, and commercial contracting practices.

2) Understanding of the relevant procurement laws and regulations.

3) Understanding of what constitutes an authorized purchase transaction.

4) Understanding of procurement methods and standards.

5) Ability to communicate, organize, and manage tasks effectively.

6) Basic analytical and computer skills.

7) Ability to summarize data, prepare reports and write effectively using proper grammar, punctuation, and tone.

8) Ability to analyze, research, and provide concise recommendations to the chain of command on required actions to anticipate, prevent, or correct problems in business processes that are supported by the GPC.

e. The Government Charge Card Abuse and Prevention Act of 2012 requires all Executive Branch agencies to establish and maintain safeguards and internal controls to prevent waste, fraud, and abuse of purchase cards. Internal controls are tools to help program and financial managers achieve results and safeguard the integrity of their programs. Effective internal controls provide reasonable assurance that significant risks or weaknesses adversely impacting the agency's ability to meet its objectives are prevented, minimized, or are detected in a timely manner. The Level 3 and Level 4 A/OPC will notify the BO or CH of any action taken due to a BO’s or CH’s non-compliance with Army policies and procedures.

f. Level 3 and Level 4 A/OPCs have the authority to apply internal controls such as suspending or cancelling BO or CH accounts; lowering credit limits; adding or deleting Merchant Category Codes (MCC); and initiating additional controls as necessary to comply with GPC policies and procedures.

g. Results of legal reviews are not sufficient justification for CHs to proceed with a particular purchase. If a CH or BO is unsure if they can proceed with a questionable purchase, they should contact the Level 4 A/OPC for guidance and confirm authority prior to making the purchase.

h. Army agencies and organizations must provide adequate resources dedicated to the GPC program within their agency/organization to ensure successful management of the program. Adequate GPC resources refer to an agency’s efficient and effective deployment of assets (e.g., span of control, personnel, training, funding, facilities, and deployment of knowledge and skills) as needed to comply with the policies, procedures, laws, and regulations governing the GPC Program. Adequate resources must be deployed to reasonably ensure that programs achieve their intended results; resources are used consistently with agency mission; programs and resources are protected from fraud, waste, and mismanagement; laws and regulations are followed; and reliable and timely information is obtained, maintained, and reported for decision-making.

i. The local contracting office must coordinate with the local personnel office to ensure procedures are established requiring all individuals to coordinate with the Level 4 A/OPC when they out-process from the Army command or activity.

2-10. Separation of Duties

a. Separation of duties is an internal control activity intended to provide checks and balances to the GPC process and to prevent or minimize innocent errors or intentional fraud occurring without detection. This internal control ensures that no single individual has control over multiple phases of a purchase card transaction. To protect the integrity of the procurement process, no one person is responsible for an entire purchase card transaction. OMB standards for internal controls require that key duties and responsibilities be divided or segregated among individuals to ensure they do not exceed or abuse their assigned authority. See OMB Circular A-123, Appendix B Revised, paragraph 4.3. To the greatest extent possible, GPC duties will be assigned to different individuals within the GPC hierarchical structure. As stated in the DoD FMR, “separation of duties precludes errors or attempts at fraud or embezzlement from going undetected. Internal controls generally require a four-way separation of the contracting, receiving/[accepting], voucher certification, and disbursing functions.”

b. Key GPC duties include making purchases and/or payments (CHs); verifying purchases and/or payments are proper (BOs, Certifying Officers, and FSOs); certifying invoices for payment (BOs, Certifying Officers, and FSOs); certifying availability of funds (Financial RMs); receiving and accepting supplies and services, including independent receipt and acceptance (acceptors); disbursing funds (Disbursing Office); and conducting policy, review, and audit functions (A/OPCs and Property Book Officers). For example:

1) BOs will not be CHs under their own MAs.

2) RMs will not be CHs or BOs with responsibility for executing their own funds.

3) Accountable Property Officers or their equivalents will not be CHs with authority to purchase accountable items (this does not apply to Property Book Hand Receipt Holders).

4) Purchases of accountable (e.g., pilferable) property, and self-generated purchases, will have acceptance performed by someone other than the CH, BO, and Certifying Officer.

5) CAC-enabled systems will generate a conflict-of-interest report to depict instances where assigned roles do not conform to DoD policy.

6) Authorization roles will be assigned to a user’s profile, with each profile allowing only that individual the ability to perform specific tasks in the system.

b. If resource constraints prevent assignment of the key duties to different individuals, as set forth in paragraph a. above, the activity must request a waiver through the Level 4 A/OPC and the CCO to the Level 3 A/OPC for approval.

c. Notwithstanding the above-described waiver process, certain key duties must not be assigned to the same individual. In no case will the same individual be both the CH and BO for a GPC account. In no case will the Accountable Property Officer or A/OPC (primary or alternate) also be a CH, BO or contracting officer making contract payments with a GPC or executing GPC purchases. A CH who is a hand receipt holder should not purchase property for their own use. The servicing bank provides the functionality to generate a report identifying potential conflicts of interest in GPC program duties.

2-11. Span of Control

a. Span of control refers to the extent of oversight and review responsibilities placed on a single A/OPC, BO, or CH. An appropriate span of control must efficiently and effectively allow the A/OPC, BO, or CH to provide reasonable assurance they can effectively perform their responsibilities regardless of the number of accounts assigned. The assigned span of control must factor in the monitoring and oversight responsibilities to include the use of MasterCard’s Insights on Demand (IOD) data mining and review process. To ensure GPC program participants have sufficient time to complete required reviews, GPC programs will abide by established span-of-control limits. The following span-of-control internal controls have been established for the Army GPC Program:

1) The number of CH accounts (not individual cardholders) assigned to a primary BO will not exceed seven.

2) An individual may not be assigned more than three CH accounts.

3) An A/OPC will not be responsible for more than 250 GPC accounts (card accounts and MAs combined). This ratio will be reevaluated biennially.

4) Primary A/OPC vacancies must be filled in a timely manner to prevent excessively burdening Alternate A/OPCs over an extended time.

5) The CPM has authority to approve deviation from the ratios in 1) through 3) above on a case-by-case basis provided the organization establishes sufficient local oversight and compensating controls. Deviation approval is a CPM responsibility and cannot be delegated.

6) For the ratios in 1) through 3) above, compensating controls include, at a minimum, briefing the HA on the deviation(s) and any related ramifications, during all subsequent Semi-annual Head of Activity Review (SAHAR) briefing(s) in which the deviation(s) remain in place.

7) For the ratio in item 2) above, as the SAHAR does not report on the number of CH accounts assigned to an individual, other compensating controls would need to be in place for any deviation(s) the CPM approves. Any deviations must be reported to the HA through the SAHAR process and annotated in the Notes section of the SAHAR report.

8) When Army policy authorizes use of the GPC for more complex transactions (e.g., by Ordering Officials), the Army should institute more stringent span-of-control ratios as appropriate.

b. A/OPCs should use PIEE/JAM or the card-issuing bank’s EAS to provide appropriate management notification and reports on various spans of control. All Common Access Card (CAC)-enabled systems supporting or using GPC data should utilize functions to define and manage all hierarchies assigned within the system—not just the GPC organizational hierarchy.

c. An individual may not be assigned more than one CH account for each special designation in their appointment. Assignment of roles includes effective from/to dates. This includes personnel assignment to an A/OPC, BO, or CH, as well as the relationships of the BO to the A/OPC and the CH to the BO. Management oversight reports should be defined to report personnel, position, and relationship assignments.

d. The card-issuing bank’s EAS report on span of control based on user ID cannot be used as an irrefutable source to support span-of-control limits, since an individual may have more than one bank user ID. A/OPCs must track all roles an individual has been provisioned/assigned using their unique CAC public-key infrastructure or other unique identifier that may be implemented by the Under Secretary of Defense for Personnel and Readiness.

e. The Army standard for span of control for a Level 4 A/OPC is 250 BO and CH accounts per Level 4 A/OPC. This total includes both the BO and CH accounts added together. Span of control updates are deemed necessary due to changing program dynamics and increased oversight burdens placed on GPC oversight personnel over time. As the micro-purchase threshold has increased multiple times over the years, additional oversight has been required by GPC personnel as the average dollar value and the types and complexity of the GPC supplies and services being purchased has increased.

f. The total number of transactions, as well as the number of assigned card accounts, must be considered when determining an acceptable card account to BO ratio. When the number of accounts or workload complexity/administration assigned to a Level 4 A/OPC exceeds the Army standard, the SCO/CCO must ensure adequate resources are made available to allow the A/OPC to successfully perform their duties. When the span of control exceeds the Army standard and the CCO elects not to provide additional resources, the CCO must submit a waiver request in writing to the CPM for approval. The waiver request must include the rationale and justification upon which the CCO has based the determination that the existing span of control is adequate to ensure program administration and that surveillance can be performed at a satisfactory level given the existing or new compensatory controls put in place. The Level 3 A/OPC must retain a copy of this documentation.

g. The Level 4 A/OPC determines whether the BO to CH ratio is acceptable upon issuance of a GPC, during the A/OPC’s annual assessment of their GPC program, or as needed. There must be a reasonable expectation that the BO can complete a thorough review of all transactions and certify the invoice within five business days of its receipt. When the ratio for CH accounts to BO exceeds the Army standard, the BO should lower the number of card accounts or request a waiver to policy. The Level 4 A/OPC will document all cases where the CH to BO ratio exceeds the Army standard. The waiver to policy request must address the unique conditions that affect the process and show, with a high degree of certainty, that the BO can be expected to comply with the review and certification procedures. The request must include the number and location of assigned CHs, the total average number of transactions made by the CHs, the amount of time the BO can devote to the certification process, the history of delinquencies, and other appropriate factors. The waiver is approved at the following levels indicated below and maintained by the approver with copies furnished to the BO:

1) 8–10 card accounts. Routed through the Level 4 A/OPC to the CCO.

2) 11–19 card accounts. Routed through the A/OPCs (Level 4 and Level 3) to the SCO.

3) 20 or more card accounts. Routed through the A/OPCs (Level 4 and Level 3) to the Level 2.

CHAPTER 3 - GPC ELECTRONIC SYSTEMS

3-1. System Requirements

All bank and Government systems used in support of GPC accounts will include the following internal controls:

1) Systems access security,

2) Systems administration integrity,

3) Data exchange security, and

4) Functional responsibility controls.