CHAPTER 15 – CONTRACT PAYMENTS

15-1. Contract Payments

a. The GPC may be used as a payment method on contracts. See FAR 32.1108. The Contracting Officer will make the determination to use the GPC as the payment method for CHs to make contract payments on formal contract vehicles up to the limit of the Contracting Officer’s warrant when the GPC payment method is proven to be more advantageous to the Government. Benefits to increasing GPC contract payments include greatly increased refunds per effort expended, exemption from GPC data mining, and faster receipt of payments. Contracting Officers normally appoint CHs residing in the contracting office as GPC contract payment CHs. The Contracting Officer or an A/OPC with the appropriate delegating authority may appoint GPC contract payment CHs outside the contracting office providing the Contracting Officer or A/OPC with the appropriate delegating authority provides adequate training and oversight.

b. All modifications impacting payment and/or funding (including options exercised) must be re-coordinated with the RM, CH, and BO to ensure the financial management system and the bank’s EAS are properly updated. Failure to do so will result in the servicing bank not being paid which may result in a possible account delinquency. The CH will maintain supporting documentation in the bank’s EAS for each contract payment made using the GPC.

c. At a minimum, procedures must be in place to ensure proper separation of duties to safeguard Government resources and to avoid the posting of double obligations associated with the use of the GPC to make payment on existing contract vehicles. Contracts where the GPC is used as the method of payment are required to be fully funded. No progress (finance) payments are authorized.

d. FPDS-NG. Contracting Officers are responsible for ensuring the FPDS reporting is completed. When the GPC is used as a method of payment against a contract, the action must be reported in an individual contract action report (CAR), and “Yes” must be selected for “Purchase Card as Payment Method” in FPDS. See FPDS reporting requirements of FAR 4.6, DFARS 204.6, and DFARS PGI 204.606. Open-market micro-purchases made with the GPC and valued less than the MPT will not be reported to FPDS. (See FAR 4.606(c) for a list of additional actions that are not to be reported.)

e. FAR policy requires the consent of contractors when contemplating the use of GPC as the payment method. Consent is typically obtained by including FAR clause 52.232-36 in the solicitation and, if the contractor does not object, the contract. Existing contracts may be modified to include the clause, with the consent of the contractor. The GPC may be used as a contract payment method if the vendor accepts the payment.

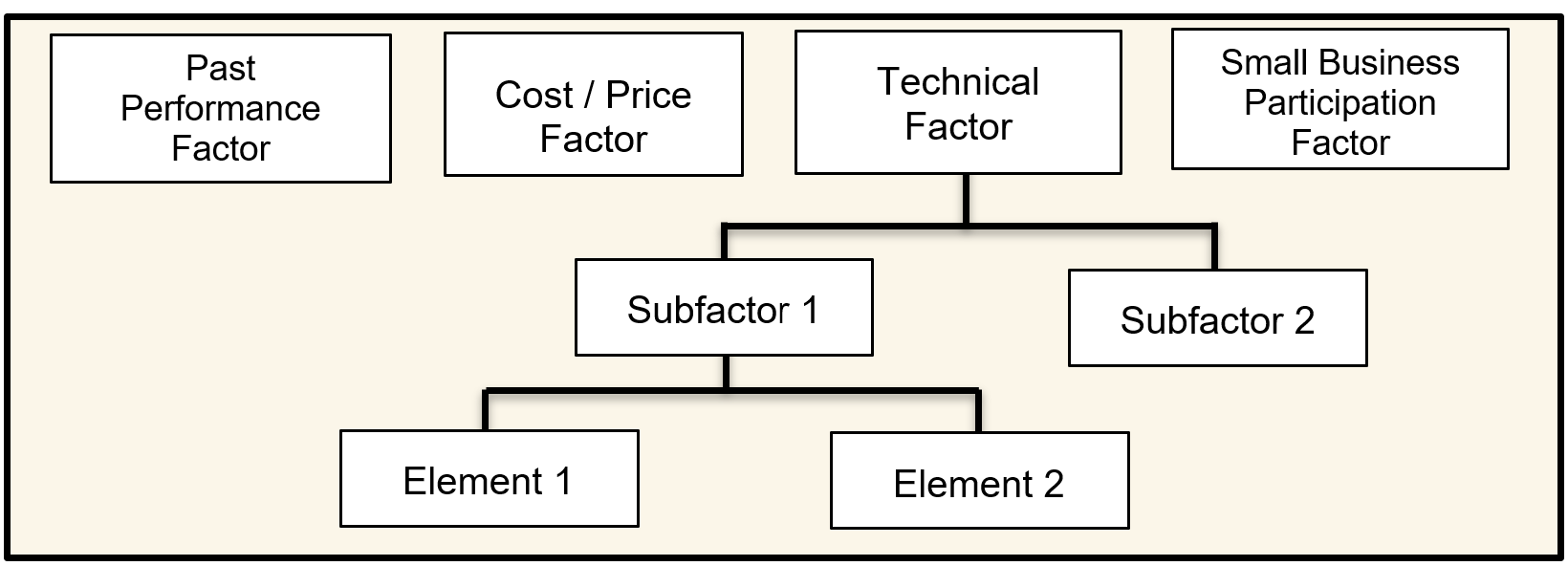

f. Contract Payment Processes. The servicing bank has two different methods for contract payments: a payment card process and a Payment Plus process. See paragraph 15-4 and Figure 15-1 for a description of the payment card process. See paragraph 15-5 and Figure 15-2 for a description of the Payment Plus process.

15-2. Contract Clauses.

FAR 32.1108 and 32.1110(d) provide instructions for use of the appropriate clause when payment under a written contract is made by GPC. When using the GPC for contract payments, the contracting officer

will insert the FAR clause 52.232-36, Payment by Third Party, in solicitations and contracts. Payment by a purchase card may also be made under a contract that does not contain the clause at 52.232-36, to the extent the contractor agrees to accept that method of payment. When the clause at 52.232-36 is included in a solicitation or contract, the contracting officer will also insert the clause at 52.232-33, Payment by Electronic Funds Transfer—Central Contractor Registration, or 52.232-34, Payment by Electronic Funds Transfer—Other Than Central Contractor Registration, as appropriate. The contracting officer should also insert DFARS clause 252.232-7003, Electronic Submission of Payment Requests and Receiving Reports.

15-3. GFEBS Purchase Order Creation

Resource managers should be aware of the following information as they create the PR/PO in GFEBS:

1) Some purchase orders (POs) are created automatically via interface upon contract award as is the case with SPS, LMP, and DMLSS. To prevent double obligations, the A/OPC must work with the servicing bank for the proper EDI file set up.

2) MIPR obligations are automatically posted after fund certification and acceptance respectively.

3) Transactions for Others (TFO). Not Receiving MIPR requires manual obligation in GFEBS for funds other than Army (“21”).

4) Navy (“97”) customer creates PO and commits in their system. Army FM enters Navy LOA in GFEBS TFO tab.

5) GFEBS Purchase Requests (PRs)/Awards. Select “CRCARD” for Pay Station.

6) GFEBS PO partners tab. Add Invoicing Party: U.S. BANCORP DoDAAC: 1E5G9

15-4. Payment Card Process Flow

The Army must follow all the necessary internal contracting procedures before starting the Payment Card Process. The CH has a GPC that is embossed and established for only “Contract Payments.” The RM builds the managing account with Account Validation Control (AVC) “EDI CP GFEBS.” Cardholder creates a manual purchase order for each contract. Cardholder provides the same card information to the contractor as they would for a purchase to the merchant. The person within the agency responsible for the payments is the BO who will certify the invoice “transaction(s)” for payment to the bank.

Figure 15-1: Payment Card Process Flow

15-5. Payment Plus Process Flow

The Army must follow all the necessary internal contracting procedures before starting the Payment Request Process. The contract payments CH is the person who will receive either a Single Use Account (SUA) or a Pre-Authorized Limit (PAL) account number for each transaction and who in turn, provides the account number to the merchant. If using SUA, it is generated for each transaction, notification is sent to the CH. The SUA comes with an Expiration Date and CVV (Card Verification Value). The person within the agency responsible for the payments is the contract payments BO who will certify the invoice “transaction(s)” for payment to the bank.

Figure 15-2: Payment Plus Process Flow

15-6. Wide Area Workflow

a. DFARS 232.7002(a)(5)(b)(1) requires that only WAWF be used to create and accept receiving reports when the GPC is used as a method of payment against a contract. As specified in DFARS PGI 253.213-70, the code “CRCARD” must be used in the Pay Official / DoDAAC field for self-administered contracts to be paid in WAWF. Contracting Officers awarding contracts authorizing use of the GPC as a method of payment must ensure contractor compliance with the requirement for vendors to use WAWF to create and submit the receiving report in accordance with the 15-6. Wide Area Workflow requirement for written acceptance. These requirements are addressed in DFARS 232.7002(a)(2) and 232.7003(a) , and DFARS PGI 253.213-70 .

b. The Contracting Officer is responsible for ensuring the WAWF clauses are included in the contract, the vendor initiates the receiving report in WAWF, and the Government acceptor documents acceptance in WAWF. The CH is required to verify acceptance has occurred in WAWF prior to approving his/her billing statement and sending it to the BO for approval and Certifying Officer for certification. Contracting Officers may not specify the GPC as the method of payment when contract administration functions will be performed by other than the contracting organization (e.g., they will be assigned to DCMA), because the contract administration office does not have insight into contract delivery and payments. To ensure proper routing of contracts paid with the GPC, contracts assigned to DCMA for administration cannot cite the GPC as the method of payment. DFARS PGI 242.3 requires that a valid payment office be designated using the Contract Administration Services Directory (CASD). GPC is not a valid CASD payment method.

c. DFARS Appendix F contains procedures and instructions for the use, preparation, and distribution of the WAWF Receiving Report (RR) and commercial shipping/packing lists used to document Government contract quality assurance. Preparation instructions and training for the WAWF RR are available at PIEE. The instructions on preparing a WAWF RR are part of the Vendor Training section.

d. On March 3, 2008, DoD issued a final rule amending the DFARS to require use of WAWF as the only acceptable electronic system for submitting requests for payment (invoices and receiving reports) under DoD contracts.

15-7. Purchase Card Receiving Report (PCRR) Process

a. Wide Area Workflow must be utilized when making contract payments with the GPC per DFARS 232.7002, 232.7003, and 252.232-7003. The contractor must use WAWF to create the purchase card receiving report (PCRR) when the GPC is used as a method of payment. The CH provides the following information to the contractor to submit PCRR into WAWF:

1) Vendor Identifier: Vendor/Company Name

2) Payment Office: CRCARD

3) Ship to:

4) Inspect by:

5) Accept by:

6) Card Issuing Bank ID: 556862

b. The contractor then uses WAWF to create and submit the PCRR. Upon notification that the goods have been received, the Government acceptor accepts the PCRR in WAWF. The CH verifies that acceptance has occurred in PIEE/WAWF and that the contracting officer has approved the invoice. The CH submits the invoice, receiving report, copy of the contract and modifications, and a current obligation/disbursement sheet to the BO for approval. After acceptance of the property in WAWF, data will flow to the Defense Manpower Data Center (DMDC) based on the Pay DoDAAC. Indicating “CRCARD” as the payment office prevents double obligation and data from entering the payment process.